Are you looking to grow your money and generate compound interest?

There are many investment accounts that promise strong returns with minimal risk, but are they the best for you?

The good news is that you're on the right track. Investing your money is a great way to grow your net worth and become wealthy.

In this post, I’ll explore the best 12% compound interest accounts so you can make more money and generate passive income from your money. Let’s get started!

- Investing in real estate with Arrived Homes

- Investing in the stock market with Acorns

- Invest in small businesses with Mainvest

Are 12% Compound Interest Accounts Real?

Earning 12% in compound interest annually is certainly possible with the right investments.

But there aren't any accounts that will guarantee this rate of return.

Past performance is no guarantee of future returns, so you could end up earning less than 12% in a given year.

However, if you're willing to accept the risk, there are a few investments that could help you earn 12% or more in compound interest to turn your money into more money.

In this post, I'll explore accounts with the best chance of reaching returns of 12% annually.

Best 12% Compound Interest Investments

There are several 12% compound interest investments you can generate compound interest with. Below are some of my favorites.

1. Invest in Real Estate with Arrived

If you want to earn 12% interest on your money, Arrived is one of my favorite platforms that's great for building wealth.

Arrived works by allowing you to invest in individual rental properties and keeping a portion of the income that property generates.

I've been using this platform for months and am super happy with the results. While there's no average return for this platform because you can pick and choose which properties you invest in – it's common to see 9% to over 15% in interest each year. Some properties have generated returns greater than 100%!

I recommend investing in a few different properties to stay diversified and maximize your returns. Check out Arrived below!

2. Earn Compound Interest with Mainvest

Small businesses can be extremely profitable and provide tremendous returns for your portfolio.

But there's one catch. Not every investor wants to put in the time and energy to start and grow a business.

That's where Mainvest can help.

This online platform allows you to invest in a variety of small businesses across the country with as little as $100.

They have target returns of 10% to 25%, making them a great option for investors looking to earn compound interest on their money.

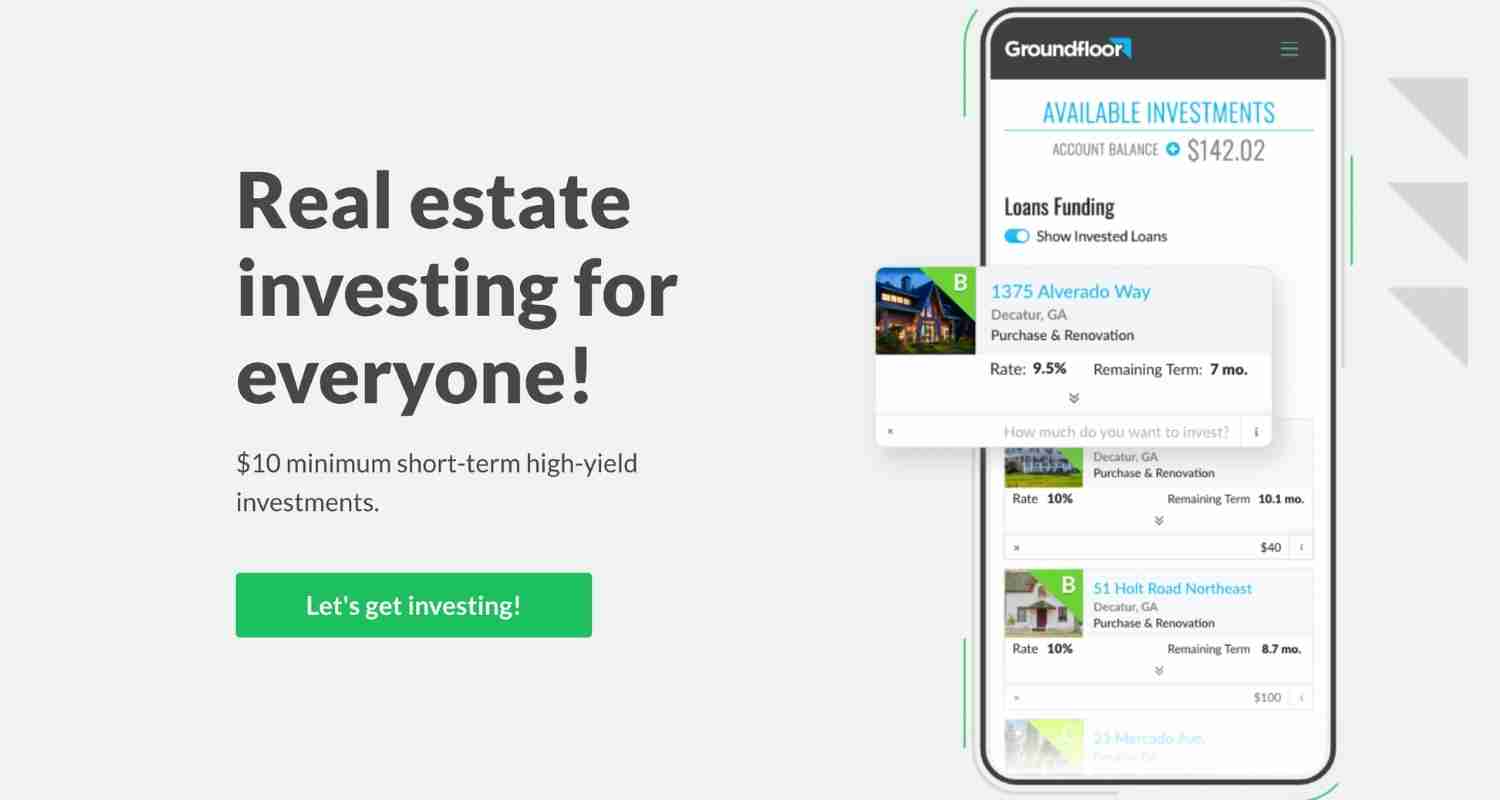

3. Invest in Real Estate Debt with Groundfloor

Another great 12% compounding interest account is by investing in real estate debt with a platform like Groundlfoor.

You can get started with as little as $10 and with over 200,000 investors, it's a trusted way to diversify your investments and earn interest on your money.

In short, you'll loan your money to investors who are looking to complete an investment property. For example, they might need some extra cash to put a new floor in the home.

In return, you'll get paid interest on your money.

Groundlfoor is a great investment platform to earn 12% interest on your money and I highly recommend it.

4. Invest in Vanguard S&P 500 ETF (VOO)

The Vanguard S&P 500 ETF, with stock ticker VOO, is a great way to generate 12% compound interest returns without having to pick individual stocks.

This ETF has been around since 2010 and has seen tremendous growth totaling a whopping 420% since its inception.

The average yearly returns of VOO have amounted to 16.74% over the past 11 years.

So, what investments are included in this ETF?

Just like other S&P 500 ETFS, VOO holds the 500 largest publicly traded companies in the US.

This includes tech giants like Apple, Amazon, and Facebook as well as other large companies like Walmart, Coca-Cola, and Visa.

Investing in VOO is a great way to get exposure to the US stock market without having to pick and choose individual stocks.

You can easily invest in this fun and many other ETFs and index funds with an investing app like Acorns or M1 Finance.

As a bonus, you'll get $10 completely free to invest when you register with the link below.

5. Vanguard Total Stock Market Index Fund (VTSAX)

Another strong option to make 12% in compounding interest is the Vanguard Total Stock Market Index Fund.

This fund investors in over 3,500 companies across the US stock market and includes small, mid, and large cap stocks.

The fund has been around since 2000 and has seen strong historical returns, averaging 11.16% annually since inception (and over 14% in the last 10 years).

The Vanguard Total Stock Market Index Fund is a great option for investors looking for a low-cost and diversified way to invest in the US stock market.

6. Invest in the Vanguard Large-Cap Index Fund (VLCAX)

The Vanguard Large-Cap Index Fund is a great option for investors looking for exposure to large cap stocks.

Large cap stocks are typically the largest and most well-known companies in the stock market.

Basically, if you want to easily start investing in the largest companies to make compound interest, the Vanguard Large-Cap index fund is for you.

This index fund will require an initial investment of $3,000 and has an expense ratio of just .05%.

Historically, this index fund has proven to be a great way to earn compound interest with returns over the last ten years averaging 14.55%.

Check out these investments that pay you every month for more ways to make passive income!7. Invest in Real Estate with Realty Mogul

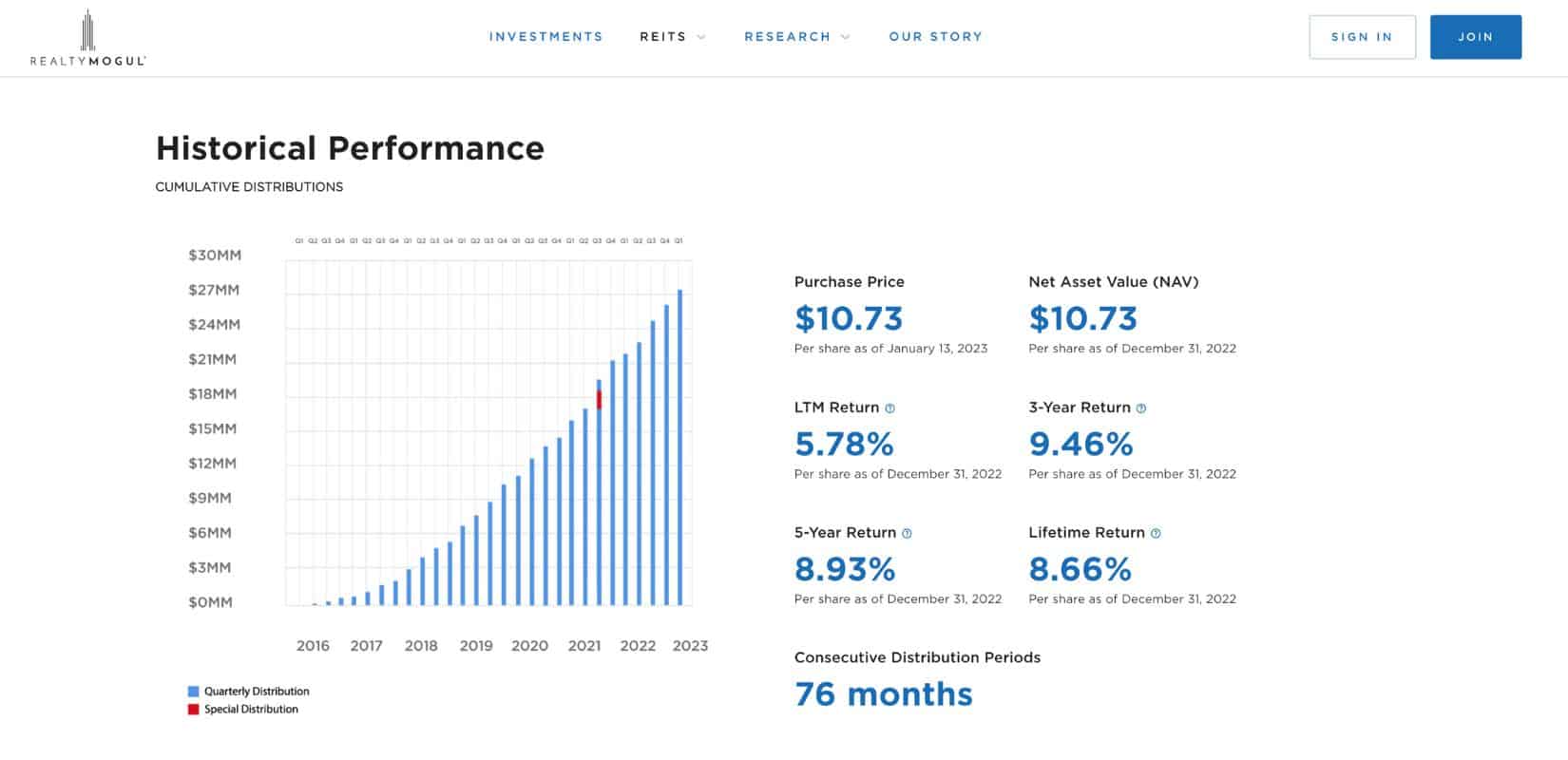

Investing in real estate is a great way to earn compounding interest and make money without needing a significant lump sum of cash required to get started.

Real estate investing is an excellent way to diversify your investment portfolio and has had historically strong returns. It's one of the best appreciating assets to own if you want to escape the rat race and reach financial freedom.

Realty Mogul is my favorite way to easily invest in real estate and earn compound interest. The minimum investment is currently $5,000 – so you'll need some cash to get started, but you can easily earn 12% interest with this platform.

So, how much money can you make?

You can see historical returns in the graph below.

8. Vanguard Growth Fun Investor Shares (VWUSX)

This fund is a great option to earn compounding interest with a minimum initial investment of $3,000.

This fund contains holdings of 265 different stocks and has had returns averaging 16% in the last 10 years.

With an expense ratio of just .38%, this is a great investment to start earning interest on your money.

9. Corporate Bonds

Some corporate bonds offer high yields, making them a great option for investors looking to earn compound interest.

What are corporate bonds?

Corporate bonds are debt securities issued by companies to raise capital. They typically have a higher interest rate than government bonds and are considered to be more risky. This money can be used for a variety of purposes, including funding expansion, research and development, or acquisitions.

When evaluating bonds, it's all about the risk reward ratio.

The more risk you take on, the higher your returns will be. The less risk, the lower your returns.

While it's certainly possible to earn 12% compound interest with corporate bonds, this can be one of the riskier investment options.

10. Peer to Peer Lending

Some peer to peer lending platforms offer the potential to earn 12% or more in interest.

Ultimately, it will depend on the type of borrowers you choose to lend money to.

Borrowers with strong credit will yield the lowest returns but will be your safest investment. Borrowers with lower credit ratings can earn much more, but are also much more risky.

It's possible to earn 12% compound interest through peer to peer lending by constructing a balanced portfolio of loans.

Not sure where to start?

There are a few main peer to peer lending options including Prosper, Peerform, or Upstart.

11. Invest in Cryptocurrency

If you want to invest outside of the stock market, cryptocurrency like Bitcoin is a strong alternative investment option.

Cryptocurrency is a digital or virtual currency that uses cryptography to secure its transactions.

Bitcoin, the most well-known cryptocurrency, was created in 2009 and has a limited supply of just 21 million coins – making it a scarce asset because of its demand.

While cryptocurrency can be volatile, it has the potential to generate high returns.

Take a look at the price of Bitcoin over the past few years. It's difficult to argue against the returns of cryptocurrency.

To invest in cryptocurrency, you'll need to open an account with a reputable exchange like Binance.

It's vital to use a trusted exchange. There have been cases where some exchanges have shut down unexpectedly from hacks and other random mysterious events, leaving investors without access to their funds.

Titan is a reputable exchange that allows you to buy and sell a variety of cryptocurrencies.

You can get started for free with the link below!

Don't worry – we hate spam too. Unsubscribe at any time.

Other Investments to Earn Compound Interest

Below are some other investments to consider if you want to make more money.

High Yield Savings Account

High yield savings account don't generate the strongest returns, however they are one of the safest investments you can make.

These accounts can pay up to 7 times the national average in interest, making them a great option for those who want to park their money somewhere safe and still earn interest.

Savings accounts are FDIC insured meaning your money is backed by the government up to $250,000 per account.

CIT Bank currently offers the highest yield savings account and it only requires $100 to get started. Create your account with the link below!

Rental Properties

Most rental properties will yield over 12% annually, but because they require work and effort, they're not always considered to be a true passive investment.

There are plenty of pros and cons of owning a rental property, so make sure to do your research before making a decision.

With this tangible investment, you can make money through several methods including appreciation, monthly cash flow, and tax benefits.

The key to success with rental properties is to find the right property in the right market that will fit your investing goals.

For example, some people might choose to invest in vacation rentals so they can use it for a portion of the year. Others might chose apartment investing to maximize their returns.

Money Market Account

Money market accounts are very similar to savings accounts except they often have higher interest rates and offer check-writing capabilities.

Additionally, there can be restrictions on how often you can withdraw money from your account.

Money market accounts can be a good way to store your money for the future, but they won't generate 12% in compound interest.

Are 12% Returns Good?

12% returns on your money is stronger than many investments like government bonds, annuities, and CDs.

When you start investing, it's safe to assume an interest rate of around 7% to 10%, so a 12% return is definitely something to be proud of.

While you likely won't get a 12% interest rate every year, it's a good goal to aim for.

10% Compound Interest Accounts

Some of the best 10% compound interest accounts include:

8% Compound Interest Accounts

Some of the best 8% compound interest accounts include:

- Rental properties

- Real estate investing with Groundfloor

- Some ETFs and mutual funds

Other Considerations

Before you go invest all of your money chasing strong returns, there are a few things you should do first.

Fees

Some investments will have an annual or monthly fee that you need to consider. Make sure you're taking these into account when calculating your returns.

For example, if you make 12% in compound interest, but you pay a 2% fee, your true returns would be around 10%.

If you're able to avoid fees as much as possible, you can see larger returns and more money in your bank account!

Risk

Risk is an important consideration when you start investing. Because you can lose money when you invest in stocks, you need to be smart.

Every investment comes with some risk, but some have are riskier than others. So how do you evaluate risk when investing?

Without going into advanced mathematical equations, you can use what's called the Sharpe Ratio.

The Sharpe Ratio is a way to compare the return of an investment to its risk. The higher the Sharpe Ratio, the better.

For example, if you're considering two investments and one has a Sharpe Ratio of 1 and the other has a Sharpe Ratio of 2, the investment with the higher Sharpe Ratio is considered to be less risky.

Check out the video below to learn how you can use the Sharpe Ratio to make better investment decisions!

Compounding Frequency

Some investments are compounded daily, while others might be compounded monthly or annually.

There's a difference in how much you can make in compound interest depending on how often your money is compounded.

You might see terms like “APR” (annual percentage rate) or “APY” (annual percentage yield) and wonder what those are.

The key difference is that APR calculate simple interest, while APY calculates compound interest.

The APY will always be larger because it takes into account the compound interest you would make.

You can use a compound interest calculator to help you determine how much money you will earn based on the compounding period.

Daily Compound Interest

There are some accounts that generate compound interest daily. While most of these are savings accounts or money market accounts, there are some that are geared towards investors.

For example, Tellus offers interest paid daily with APYs up to 6% on your money!

You can check out these investments that pay daily for more info!

Inflation

Inflation is another consideration when investing. While you can't do anything about it, it's important to be aware of how it can impact your money.

Inflation is the rate at which the prices of goods and services increase over time.

As inflation goes up, the purchasing power of your money goes down. That means that if inflation is 3%, and you have $100 in the bank, after one year you would need $103 to have the same purchasing power.

The US Federal Reserve has a target inflation rate of 2%, but it can be incredibly difficult to stay at this level depending on economic conditions.

Currently, inflation is at record levels at over 8% annually. This can make it difficult to keep up with the rising prices of goods and services.

So how does this impact you investments?

This can mean your true returns will be much lower than your real inflation adjusted returns.

If your investment returns are 10%, but inflation is at 8% – your true return is only 2%.

The video below can help you learn how to invest during times of high inflation.

Pay Off High Interest Debts

High interest debts like credit card debt, some student loans, or personal loans should be a priority for your finances.

These debts can have interest rates higher than 7% – making them difficult to manage and pay down.

If you have a decent amount of cash, consider paying down these debts before investing.

You can use a debt snowball or debt avalanche methods to pay down your debts quickly.

Have an Emergency Fund

Having an emergency fund, or rainy day fund, is another critical step in your financial journey.

You should have at least 3-6 months of living expenses saved in an easily accessible account. This will help you cover unexpected costs, like a medical emergency, job loss, or car repair.

Final Thoughts on 12% Compound Interest Accounts

Earning 12% in compound interest from your investments is an awesome goal to strive for and it's possible through some methods.

There are several index funds, ETFs, and other investment options that you can grow your money with earn compound interest.

It's important to remember that past performance is no guarantee of future results, so be careful and only invest what you can afford to lose.

To limit risk, diversifying your portfolio is essential. By using a combination of stock market investments as well as savings accounts or money market accounts you can keep your money safe and generate compound interest effortlessly.

Don't worry – we hate spam too. Unsubscribe at any time.