Investing apps have become extremely popular over recent years and for good reason.

The offer the ability to easily invest in the stock market without much effort. Many investing apps offer services to automatically invest for you – making it that much simpler.

There's no doubt that investing your money is a tremendous way to grow your wealth and time is your greatest asset – making it important to start investing as early as possible.

In this post, I'll explore if investing apps are worth it, the best investing apps to build wealth, and much more. Let's get started!

Reasons Investing Apps are Worth It

Below are some of the top reasons investing apps are a good idea. If you're asking yourself “Are investing apps worth it?” keep reading!

Easy to Use

Micro investing apps are incredibly simple to use. Many of these investment apps can be easily downloaded on your smartphone and you can be up and running within minutes.

After creating an account, you can link your bank account and start making trades.

The majority of investment apps allow you to invest in individual stocks, ETFs, index funds, and mutual funds. This makes your life much easier as an investor. You won't need to craft a specific investing strategy to grow your money.

These apps also make analyzing trades easy to understand. Finding metrics like expense ratios, EPS, and other stats are easy to navigate.

Commission Free Trading

In the last few years, many online brokerages have moved towards commission free trading that can save investors a tremendous amount of money.

Previously, it was common to pay around $5 per trade – which can add up for many investors.

This alone can make many investment apps worth it.

Fractional Shares

Some investment apps offer the ability to purchase fractional shares. These can be thought of as “chunks” of an entire stock. Because some individual stocks can be quite expensive, this allows smaller investors to start investing without needing a fortune.

For example, Amazon's current stock price is hovering around $3,000 per share. This means if you want to invest in Amazon, you'd need $3,000. However, with fractional shares you could invest as little as $10 in Amazon.

By using micro investing platforms you can invest without needing a large sum of cash.

Low Minimum Investments

Most investment apps have relatively low minimum investments. This makes them attractive to any investor – whether you have $500k to invest or $20 to invest.

By using apps like Acorns you can start investing with just $10.

Best Investing Apps

Below are some of my favorite investing apps for anyone to build wealth and generate passive income.

Acorns

Acorns is a micro investing app that is perfect for novice investors looking to grow their wealth. This app allows you to easily execute trades and it will automatically round up your spare change and invest the difference.

You can invest in a variety of different assets including index funds, ETFs, and more.

As a bonus, you'll get $10 completely free to invest when you create a new account with the link below.

If you're looking for a different option, there are plenty of apps like Acorns you can use to start investing.

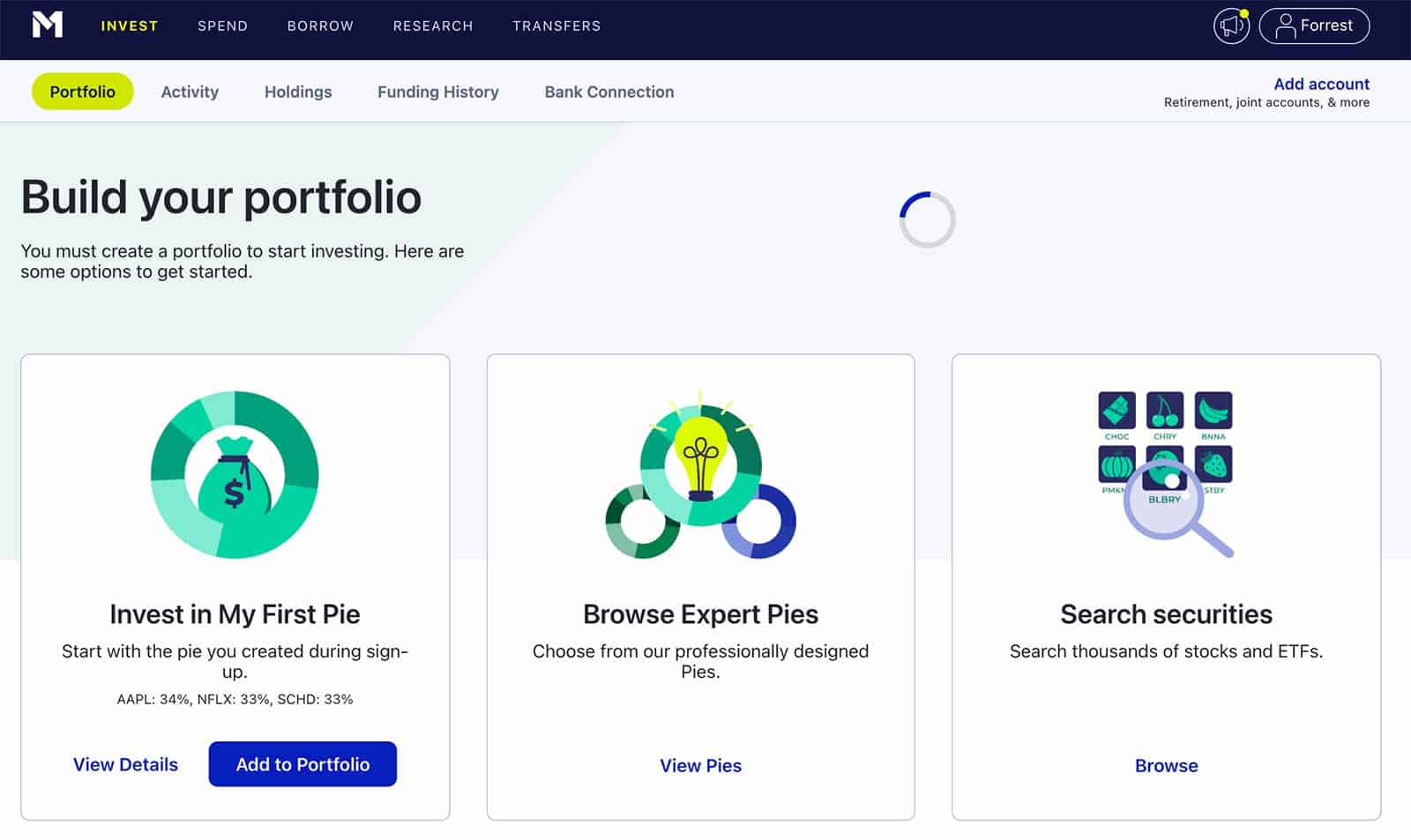

M1 Finance

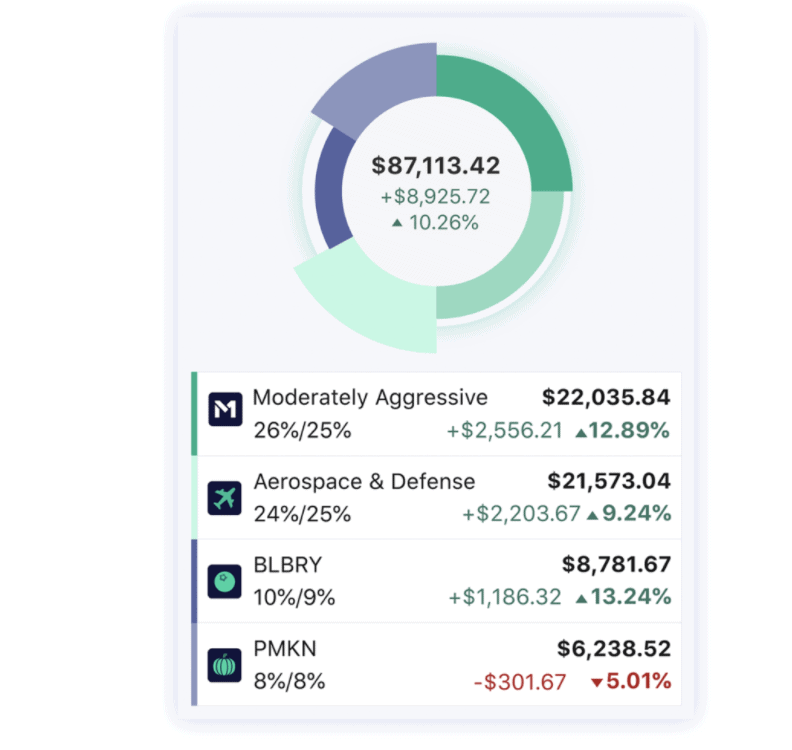

M1 Finance is another great micro investing app to start investing in a variety of stock market offerings.

M1 Finance does require slightly more to get started with $100 – which is still relatively low. M1 Finance offers a variety of other financial services like the ability to get a debit card or credit card.

Fundrise

Fundrise is another investment app except it specializes in real estate instead of stocks. This platform will require a slightly large investment at $500 – but it's a great way to diversify your investment portfolio and optimize your returns.

With Fundrise you can generate annual returns slightly larger than the stock market.

Stash

Stash is another micro investing platform you can use to invest in all of the most popular stocks, index funds, ETFs, and more.

You'll get $5 free when you open a new account – so you'll want to take advantage of this free money.

Don't worry – we hate spam too. Unsubscribe at any time.

What Are Micro Investing Apps?

Micro investing apps, are apps that allow you to invest without a large amount of cash. When it comes to micro investing there are plenty of options to help you get started.

Everything from mutual funds to index funds can be accessed through these apps – so you won't have to craft a specific investing strategy.

Building wealth and growing your portfolio can be difficult for novice investors – but investing apps make it easy to get started and are certainly worth it.

How Much Money Can You Make with Investing Apps?

If you're looking to make extra cash from your investments, using investing apps is a no brainer.

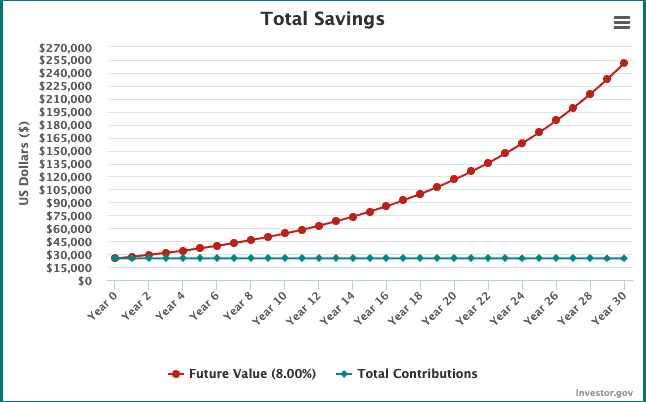

The amount of money you can make can be quite considerable. While the stock market averages returns of around 7% to 10% annually, your money will grow exponentially.

For example, if you invest $25k into a well-diversified portfolio that generates 8% annual returns, your portfolio would swell to over $250,500 in 30 years.

What are Robo Advisors?

If you're searching for the best investment apps – there's a good chance you've come across the term robo advisor.

But what exactly is it?

Robo advisors are investment management software that help you create an investment strategy that is right for you given your circumstances. You'll insert your information, and the advisor will help you make with your financial planning needs.

Some robo advisors might charge an annual fee for their services, so be sure to check the terms before you start investing.

Are Investment Apps Safe?

Investment apps can be considered just as safe as a traditional brokerage account. When it comes to personal finance – keeping your money safe and secure is essential.

Your investing app should be regulated by the Security and Exchange Commission to ensure it isn't a scam.

It's also wise to take a look at the companies history to ensure they aren't a startup that could go under if things go south.

As with any website, be sure to use a secure password and try to keep your accounts secured by dual authentication.

How Old Do You Have to Be to Use an Investment App?

Each investment app will have its own set of rules and regulations, but it's common that you'll need to be at least 18 years of age to utilize an investing app.

You can read my guide on how old you need to be to invest in stocks for more help.

Final Thoughts on Are Investing Apps Worth It

If you're still wondering “Are investing apps worth it?” we hope this article helped make your decision easier.

Investing apps are a tremendous asset you can use to grow your wealth in the stock market without needing a significant amount of cash or a tailored investment strategy.

Investing your spare change can be an excellent way to master your finances and take control of your money. So what are you waiting for? Don't forget to claim your free $10 from Acorns today!

Don't worry – we hate spam too. Unsubscribe at any time.

Recommended Reading

13+ Best Tangible Investments to Build Wealth (2024 Guide)

Looking to grow your wealth and make more money? Consider these tangible investments to build wealth and boost your income.

How to Invest 500k: 24 Safe Methods (2024 Guide)

Want to learn how to invest $500k? Explore these 24 best ways to invest $500,000 to build wealth and make money!

How to Invest $200k: 16+ Safe Ways (Ultimate 2024 Guide)

If you have $200k to invest, check out these safe ways to invest $200,000 so you can earn passive income!

Fundrise vs Rental Property: Which is Better? (2024 Guide)

Not sure where to start investing in real estate? Fundrise and rental properties are great options, but which is better? Read to learn!