Are you feeling stuck in your career? Do you dread going to work everyday?

You're not alone! With over 60% of people reporting they are unhappy with their work, getting out of the rat race is something most people strive for.

In this post, I'll explore how to get out of the rat race, how I was able to manage finances and generate passive income to escape the rate race, and much more. Let's get started!

What is the Rat Race?

The “rat race” is a phrase that can mean a variety of things. For most people, the rat race is used to explain the never ending competitive nature to obtain money and power.

The rat race is often tied to a corporate job that requires a significant amount of work and energy to keep running in the race. In essence, you trade time for cash through your job.

Many people affiliate this phrase with the phrase “keeping up with the Jonses” as a way to describe the middle class that the majority of Americans live in.

What Escaping the Rat Race Means

Escaping the rat race means you'll have the freedom to do whatever you want, whenever you want, without having to worry about money or a job holding you back.

It's about creating a lifestyle that is sustainable and allows you to live your life on your own terms.

It's important to note that escaping the rat race doesn't mean you have to be wealthy. In fact, many people who escape the rat race do so by living a more simple lifestyle and spending their time wisely to meet their basic needs.

Don't worry – we hate spam too. Unsubscribe at any time.

What is the American Dream?

Another common phrase you'll hear tied to the rat race is the American dream.

The American dream is the belief that anyone, regardless of where they were born or what their circumstances are, can attain their own version of success in America.

This dream is often played out with a home in the suburbs, a nice car, a happy family, and a successful career.

For many people, the American dream has become the rat race. They are working day and night to maintain their lifestyle and keep up with those around them.

But is this dream really worth it?

Spending time building an empire for the company you work for, only to have the last 10 to 20 years of your life to spend your time doing what you want.

If that's not a reason to escape the rat race and enjoy life, I don't know what is!

Why You Need to Escape the Rat Race

Being in the rat race can cause many physical and mental tolls on your life. Below are some of the top reasons you should aim to quit the rat race and start living life on your own terms.

Mental Health Concerns

On your journey to financial success through the rat race, your mental health can take a massive toll.

Do you get the Sunday scaries?

The Sunday scaries are the anxiety and stress that comes every Sunday evening and afternoon knowing that you have to work the next day.

This can be a key indictor of poor mental health that can lead to a plethora of physical health problems over time, especially if you don't want to work anymore.

Spend More Time with Family and Friends

Working 9 to 5 can limit your ability to spend time with friends and family.

The majority of people work traditional jobs that prevent them from having a large social life outside of work.

If you have kids, this can potentially be extremely detrimental to their development also.

Kids need a strong support system of family and friends to thrive, and working long hours can prevent you from providing that for them.

Spend Time on Hobbies

If you have hobbies and activities you like to do outside of work, the rat race can prevent you from doing those things as well.

Have you ever had a project you've been working on for months or years that you haven't been able to finish because of work?

It can be very frustrating to not have the time to work on things you're passionate about.

How to Quit the Rat Race

Luckily, there are plenty of methods to help you escape the rate race and take back control of your life. The FIRE community has found investing as a great way to escape the rat race and reach long term happiness.

Become Self-Employed to Escape the Rat Race

While some people joke that you'll trade your 9 to 5 for a 24/7 when you become self employed, there are many benefits of entrepreneurship that should be considered.

While it's certainly not for everyone, self employment can be a great way to escape the rate race and gain financial independence.

You might be wondering what the difference is between being self-employed and being a business owner.

In reality, there aren't a ton of differences. Both terms can be used interchangeably to describe someone who isn't employed by someone else.

The main difference is that business owners typically are working to grow a larger enterprise while self-employed people are satisfied with a smaller goal of providing for themselves.

Examples of self employed individuals include freelancers, contractors, and some solopreneurs.

So, how can you become a business owner or be self-employed?

There are plenty of profitable business ideas you can consider to escape the rat race. I recommend opting for a business model that is low cost to start and has a clear path to profitability.

Some people might think you need the next big business idea if you want to become successful, but that's certainly not the case.

Some small business owners can make over 7-figures from their business, so don't let anyone tell you that your business idea isn't good enough.

For example, starting a cleaning business can be a great option to help you escape the rat race with the potential of making millions given it's a $46 billion industry.

Another example is running an online business like a blog or website. The amount of money you can make with this business is tremendous and enabled me to quit my job at just 27 years old.

It's important to remember that 65% of businesses fail within the first 10 years of operations, so you'll want to have money set aside to pay your living expenses for at least a year and enough money to cover any unexpected expenses.

Unfortunately, becoming a business owner won't help your financial stress. You'll need to figure out how much money you'll need to make to pay your monthly expenses.

Check out these or these business ideas for men or these business ideas for women!Start a Side Hustle

A side hustle can be a great way to increase your income without necessarily having to quit your day job.

This additional income can be used to save money, invest to reach financial independence, or simply to have more money to live a better lifestyle.

There are endless possibilities when it comes to starting a side hustle, so you'll want to pick something that you're passionate about.

Before starting a side hustle, here are some tips to help you earn money!

- Write down your financial goals

- Keep in mind any expenses that come with your side hustle

- Don't forget to stash some money for your taxes

- Don't be afraid of failure

There are tons of side hustles to consider but some of my favorites include:

- 44 Best Side Hustles for Men

- 100+ Side Hustles For Women

- 23 Best Side Hustles for Accountants

- 33 Best Summer Side Hustles

Invest in Real Estate

Real estate investing is an excellent way to get out of the rat race and reach financial independence.

There are many forms of real estate investing you can consider to generate enough passive income to cover your living expenses and keep your bills paid.

Crowdfunded Real Estate

One of the easiest way to start investing in real estate is through crowdfunding platforms like Realty Mogul.

These platforms allow you to pool your money with other investors to invest in larger real estate projects like apartment investing and other multi-family projects.

The amount of money you can make will depend on current economic conditions but it's possible to make over 15% some years in passive income with this method.

Commercial Real Estate

Commercial real estate investing is another strong investment option to make passive income and reach an early retirement.

This type of investing focuses on purchasing property like office buildings, warehouses, or retail storefronts.

By using a platform like EquityMultiple you can easily invest your money into these assets to generate passive income and reach financial freedom.

The average return with EquityMultiple is 17.4% – which makes it one of the best compound interest investments you can make.

Long Term Rental Properties

Rental properties are a more hands-on type of investment that can still generate great returns.

This method of real estate investing involves purchasing a property, usually with the intention of fixing it up and renting it out.

You can then use the rental income to cover your mortgage payments, property taxes, and other expenses.

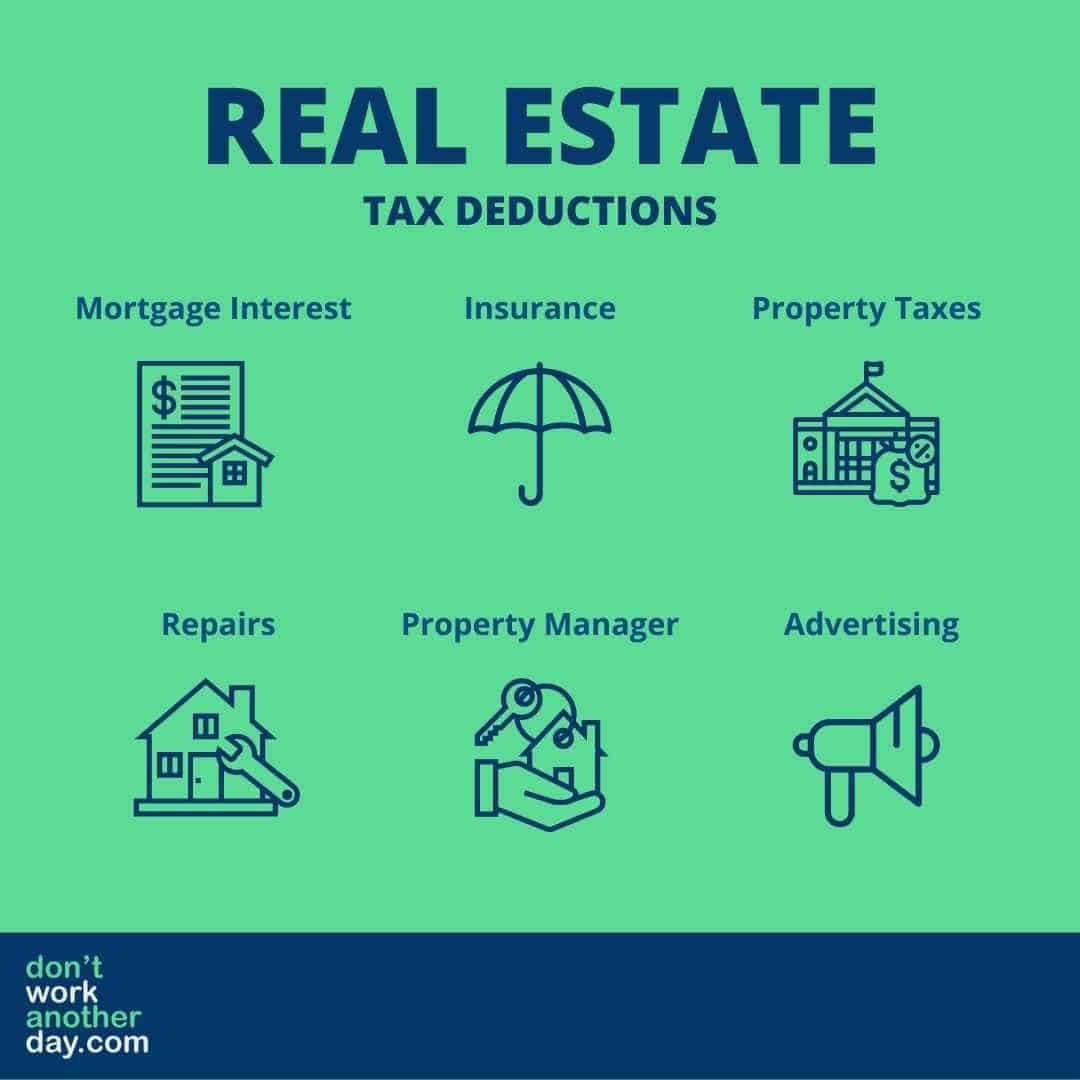

There is one big advantage that comes with a rental property as opposed to other forms of investing, the tax benefits.

By taking deductions like depreciation, mortgage interest deductions, and other expenses, you can offset a lot of the income you make from your rental property, which can result in a significantly lower tax bill each year.

After considering the tac benefits, it's possible to generate returns of over 20% annually for some properties.

There are two main disadvantages with this investment option, however.

First, you'll need to have money set aside for a down payment on the property – which will need to be at least 20% of the properties selling price.

Depending on the price of the home, this could mean over $40,000 in cash that you need to have saved up to purchase an investment property.

The second disadvantage is that this option requires a lot more work than other investments on this list.

Because you'll need to find tenants, collect rent payments, and maintain the property, it's not a completely passive form of income.

But don't worry, you have options. If you want your property to make passive income, you can opt to hire a property management company to do all of the work for you.

While this will eat into your profits, it can be an easy way to reduce the amount of work you'll need to do (isn't that the reason you're escaping the rat race anyways?).

Property management companies will charger around 10% of the properties rental price plus a fee to place new tenants – which can still leave you with a healthy return each year.

Short Term Rentals

While the majority of investment properties will be long term rentals, short term rentals can be a very profitable venture to escape the rat race if you have a location that is desirable.

This method of real estate investing involves renting out your property on platforms like Airbnb or VRBO for short periods of time, usually a few days to a few weeks.

Because you're only renting out your property for short periods of time, you can charge a premium price – which can lead to returns of over 25% each year.

But there are a few disadvantages with this option as well that not everyone will prefer.

You'll almost certainly need a property manager which can charge upwards of 25% of your monthly income because of the high turnover.

Additionally, you'll need to make sure your property is located in an area that people will actually want to visit.

While this doesn't seem like a big deal, it can be tough to find the right location – which can make this option a bit riskier than others on this list.

REITs

Real estate investment trusts are a simple way to make passive income from investments in real estate via the stock market.

REITs are a special type of company that own and operate a portfolio of income-producing real estate assets like office buildings, warehouses, shopping centers, and apartments.

You can use an investing app to invest in them like Acorns or M1 Finance.

Check out these ways to invest and make money daily!Invest in the Stock Market

The stock market is an easy way to build your passive income portfolio and escape the rat race.

Just like real estate, there are a few different ways you can invest in the stock market that I'll explore below.

Index Funds

Index funds are a great appreciating asset you can use to diversify your investments and escape the rat race.

With index funds, you're investing in a basket of stocks that track a specific market index like the S&P 500.

This is a great way to passively invest in a wide range of companies without having to pick and choose individual stocks.

Index funds have low fees and can be a great way to generate returns of 7-10% each year with no effort.

You can use a platform like Acorns to start investing in the stock market with as little as $5. As a bonus, they'll give you $10 in free stocks to get started. Create your account below to start investing!

ETFs

ETFs, or exchange traded funds, are another great passive income investment. Similar to index funds, ETFs track a specific market index or sector.

Just like index funds or other stock market investments, you can see returns around 7-10% each year.

You can use an investing platform like Acorns or M1 Finance to start investing in ETFs with as little as $5.

Mutual Funds

Mutual funds are similar to index funds or ETFs in that they contain many different investments inside of the holding.

The main downside to mutual funds is that they tend to have higher fees than index funds or ETFs, but this can sometime be offset by slightly stronger performance.

Mutual funds are actively managed, meaning there's someone making decisions about what to buy or sell inside of the fund.

This can be a good or bad thing depending on the fund managers skill.

Individual Stocks

Individual stocks can be another way to grow your money and escape the rat race if you're a skilled trader.

While I wouldn't recommend this strategy for most people, there are some investors who have made a living trading stocks in the short term.

Invest in Small Businesses

If you don't want to spend the time and energy growing your own business, another option is to invest in small businesses to grow your monthly income and escape the rat race.

By using a platform like Mainvest, you can easily invest in businesses across the country with as little as $100.

This is a great way to diversify your investments and support small businesses while also growing your income.

Consider Peer to Peer Lending

If you have some cash lying around that you're looking to invest, peer to peer lending can be a great option.

Peer to peer lending platforms like Prosper and LendingClub allow you to invest in personal loans and earn interest on your investment.

The amount of money you can make will depend on the borrowers credit, but in most cases, you can earn anywhere between 5% and 10%.

Pay Off Your Mortgage

One of the largest expenses that most families have is their housing costs.

By paying off your mortgage early, you can free up a large amount of money each month that can be used to save for retirement or invest in other assets.

Just think, if you didn't have a mortgage payment each month, you'd probably need much less money to escape the rat race.

Store Money in a High Yield Savings Account

Storing your money in a high yield savings account is an easy way to turn money into more money without any work.

By creating an account through CIT Bank you can make your money work for you and earn 5 times the national average in interest.

With a $100 minimum requirement, you can store your cash and get paid each month for your money.

Tips to Escaping the Rat Race

Below are some tips to help you escape the rat race and reach financial freedom.

Avoid Lifestyle Creep

Lifestyle creep is when your lifestyle gradually becomes more expensive as you earn more money.

For example, if you get a raise at work, you might start eating out more often or purchase a nicer car. While these expenses might seem innocent, it can hamper your ability to escape the rat race.

While there's nothing wrong with enjoying your success, it's important to avoid letting your lifestyle creep too much or you'll never be able to escape the rat race.

Do the Math

If you plan on relying on your investments to escape the rat race, you need to know how much money you need.

You will need to calculate withdrawal rates from your investments to determine if you'll have enough money to keep paying bills and match your current spending habits.

Live Below Your Means

Living below your means is critical if you want to escape the rat race.

This means that your spending should be well below your current income.

In the FIRE movement, members strive to achieve spending levels as low as 15% of their income to boost their savings and reach financial freedom faster.

If you're currently living paycheck to paycheck, you'll need to find a way to cut your monthly expenses so you can start saving money.

There are a number of ways to do this, but it will require some effort on your part.

Create a Budget

Budgeting can be a helpful tool that can enable you to escape the rat race much faster.

By budgeting effectively, you can make sure that your spending is well below your current income so you can save as much money as possible each month.

There are a number of different budgeting methods you can use, so find one that works best for you.

I recommend using tools like YouNeedaBudget that can help you setup and track your budget easily.

Establish an Emergency Fund

Having an emergency fund is essential if you want to avoid going into debt when unexpected expenses occur.

Ideally, your emergency fund should have enough money to cover 3-6 months of living expenses or more.

This will help ensure that you're prepared for anything life throws your way and won't have to rely on debt to make ends meet.

Start ASAP

If you want to escape the rat race, the earlier you prepare, the better.

The sooner you start saving and investing, the more time your money will have to grow.

Compounding interest is a powerful tool that can help you reach your financial goals much faster.

So, if you're serious about escaping the rat race, start taking steps today to reach financial freedom.

Find a New Job

Finding a new job can be a good way to make more money in the short term so you can increase your savings and prepare to escape the rate race.

As a bonus, you might enjoy your job more and find that it's less stressful than your current job.

If you hate your job and don't think your pay is adequate, finding a new job can be a great way to improve your financial situation.

Invest in Yourself

Escaping the rat race will require you to invest in yourself and your personal development.

When you invest in yourself, you might not see the results quickly, but over time you can develop new skills that will help you make more money.

Put in Your Two Weeks

When you leave a job, it's always important to give your employer notice of your departure.

You might think that because you're escaping the rat race, you don't need to give your two weeks notice but this can be a huge mistake.

Not only is it the courteous thing to do, but it will also help you maintain a good relationship with your former employer in case you need to ask for a reference or recommendation in the future.

Set Goals and Track Your Progress

Escaping the rat race isn't an overnight accomplishment.

For most people, it can take years to escape the rat race and achieve financial freedom.

That's why it's important to set goals and track your progress along the way.

This will help you stay motivated and on track to reach your ultimate goal.

Try to set SMART goals. SMART goals are:

- Specific

- Measurable

- Achievable

- Relevant

- Time-bound

By using SMART goals, you'll have a much better chance of escaping the rat race because your goals will be clear and attainable.

Final Thoughts on How to Get Out of the Rat Race

Understanding how to get out of the rat race can take some time and it certainly won't happen overnight.

If you want to get out of the daily grind of working for someone else, it's wise to start with a plan for your finances.

Managing your spending, increasing your income, and investing for the future are all key steps to take if you want to escape the rat race.

Don't worry – we hate spam too. Unsubscribe at any time.