If you have $400,000 to invest, you might be wondering what to do.

Between the stock market, real estate, digital real estate, and other alternative investments – the options can be overwhelming.

But you need to manage your money correctly so you don't lose money or make bad investments.

In this post, I'll explore how to invest $400k safely, how to invest $400,000 for income, and much more. Let's get started!

- Real estate investing with Arrived or Realty Mogul

- Stock market investing with Acorns or M1 Finance

- Investing in cryptocurrency with Binance

How to Invest $400,000

1. Invest in Rental Properties with Arrived Homes

If you have $400,000 to invest, rental properties can be an excellent way to grow your money. But there's one key problem, they can be a hassle to manage.

That's why I recommend using Arrived to invest in individual rental properties across the country.

You only need $100 to get started, meaning the stakes are low if you don't like the platform, and there's some significant upside if you choose the right properties. Some properties have grown over 100% since their control – making it one of the most profitable investments worth considering.

There's a 1% management fee that can reduce your profits, but this isn't much compared to other investment platforms.

The best part is that you don't have to deal with tenants on your own, and the team strongly vets properties before listing them. This means it's a hands off way to make passive income and grow your wealth.

-

$100 minimum investment.

- Access to individual properties so you can pick and choose which properties to fund.

- 1% management fee.

- Some offerings are funded quickly.

Overall, I highly recommend checking out Arrived and investing a portion of your money into this real estate platform.

2. Invest in Index Funds

If you're looking to grow your money in the stock market, index funds are one of the best investments to turn your money into more money.

Index funds are an easy way to keep your investment portfolio diversified because they track a specific market index. This means that when the entire stock market sector goes up, your investment goes up with it – giving you exposure to potentially large returns. That said, if the stock market declines, your returns will follow.

The best part about index funds is that they're incredibly easy to invest in and they have very nominal fees. You can get started with an investing app like Acorns and receive $10 free when you make your first deposit. I used Acorns for years and love how easy it is to use. And who can say no to free stocks!?

With index funds you can earn anywhere from 7% to 10% annually from your investment, making it a strong and stable option to build wealth over the long term.

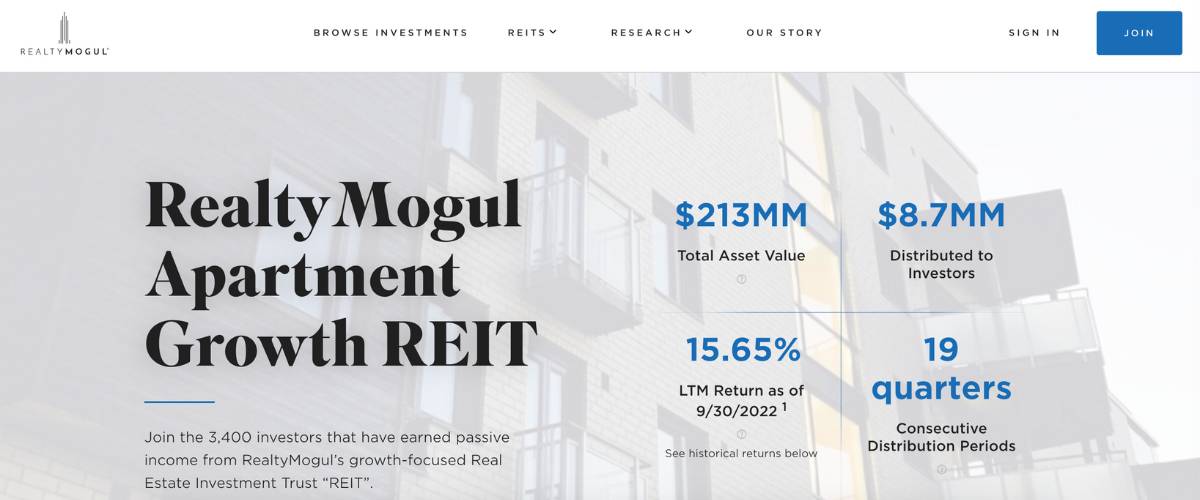

Invest in Crowdfunded Real Estate with Realty Mogul

Crowdfunded real estate can be an excellent way to invest your money and generate cash flow each month from your investment.

With crowdfunded real estate, you can use a platform like Realty Mogul to invest in apartment buildings and other large multi family complexes that you would normally need millions to get started.

It works by pooling money together from many investors to buy a property.

You can then earn money from the monthly rent payments that come in from the tenants.

This is a great hands-off way to invest in real estate and earn monthly cash flow.

I love Realty Mogul for several reasons. First, the minimum investment is $5,000 – making it a viable option whether you have $5,000 to invest or $400,000.

Secondly, the average returns are extremely competitive. Many investors have made over 10% annually on their money – making it one of the best compound interest investments.

Finally, it's extremely easy to use and navigate the platform.

If you're ready to get started, register below to create your free account!

Invest in Commercial Real Estate

Commercial real estate is another lucrative investment to make passive income. It offers several benefits over residential real estate and can be an excellent hedge against inflation.

Whenever you think of commercial real estate, you probably think of office buildings, but that's only a small portion of what's available. You can also choose storefront real estate, storage units, and other assets.

For accredited investors, my favorite platform is EquityMultiple where you can invest in commercial real estate with as little as $5,000.

The average return for EquityMultiple is 17.4%, making it one of the strongest returning investments you can make.

Ready to get started? Create your account here to start investing in commercial real estate.

If you're not an accredited investor, you can also use Streitwise to get started with as little as $5,000!

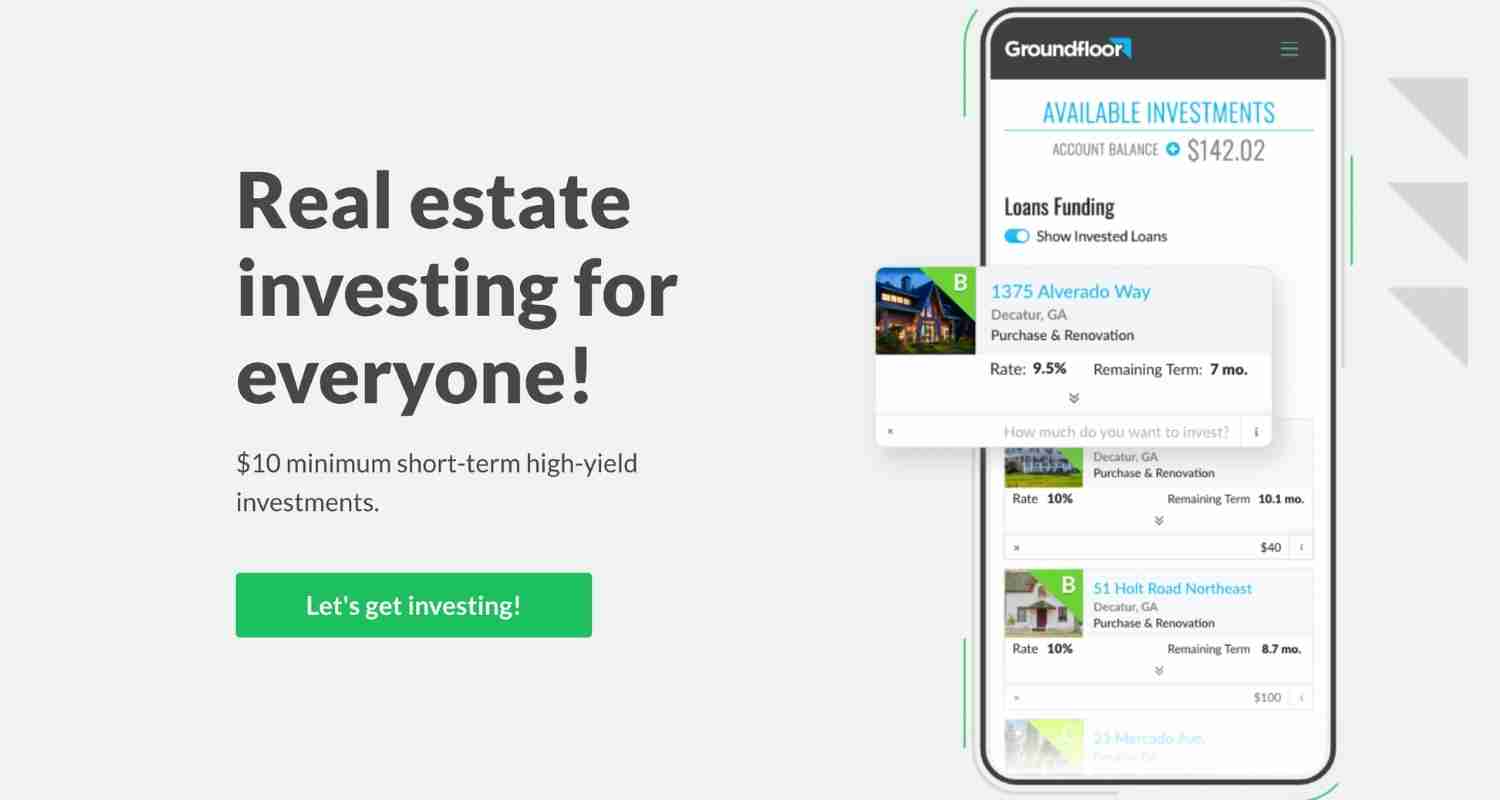

Invest in Real Estate Debt

Real estate debt is another solid investing option and a great way to diversify your portfolio to optimize returns and limit your risk.

Platforms like Groundfloor allow you to invest in short term real estate debts that are structured to help you build wealth.

Here's how it works. Whenever someone is looking to flip a property, they need money for the short term to complete their project. For example, maybe they need to put in a new floor or purchase new appliances. If they don't have the money themselves, they can use a platform like Groundfloor to find money from investors to complete their project.

For investors, you'll earn interest on your money and can choose to have it paid back monthly or when the loan is complete.

Interest rates can be as high 15% or more with the average around 10.5% – making it a very attractive investment.

Another reason I love Groundfloor is that the minimum investment is just $10. If you're ready to get started, create your free account here!

Invest in a REIT

A REIT, or real estate investment trust, is another easy way to build wealth with real estate investing.

REITs are publicly traded on the stock market and function similar to how a mutual fund does.

The money is pooled together from many investors and used to purchase income-producing real estate properties.

The goal of a REIT is to generate monthly dividends for shareholders from the rental income of the properties.

REITs have become increasingly popular in recent years and offer a great way to invest without having to put down a large sum of money.

You can get started with an investing app like Acorns. With Acorns you can get a free $10 when you make your first deposit.

Purchase Your Own Rental Property

Don't mind doing a little work? Purchasing a rental property is another popular real estate investment option that can help you generate great returns.

The downside of this investment is that it will require the most work and energy when compared to other investments, because you'll have to find and vet tenants, maintain the property, and complete the managerial work that comes with rental properties.

You'll also have to spend time upfront finding a property and ensuring the numbers are profitable for your money.

The main benefit is that your returns can be superior and often over 15% annually, if managed correctly.

If you're willing to do the work and have the time to manage tenants, collect rent payments, and perform maintenance on your property, owning a rental property is a great way to invest $400k in real estate.

Invest in ETFs

ETFs are another popular stock market investment many investors love because of the low fees.

The average returns of ETFs will depend on the specific fund you're investing in and current economic conditions, however, many ETFs are known for providing high returns of around 10% annually and are a great way to build wealth.

ETFs are very similar to index funds and mutual funds, and they can be bought and sold on the stock market just like you would an individual stock.

You can check out some of these great ETFs for more info.

You can use platforms like M1 Finance, Acorns, or other investing platforms to get started.

Invest $400k in Mutual Funds

Mutual funds can be another great investment option to make passive income and reach financial freedom.

With mutual funds, the fund is managed by a professional fund manager who actively makes decisions about the investments held within the fund. This means that the fees for mutual funds tend to be higher than index funds or ETFs but sometimes they can perform much better than the others.

The average return on a mutual fund is around 7% annually, but some funds have provided returns of over 12% in the past.

While mutual funds are a great way to make passive income, they do come with some risk – just like other investments.

Finding a mutual fund with low fees can be a great way to start investing in stocks and equities while keeping your portfolio diversified.

Invest in Dividend Stocks

Dividend stocks are a popular way to generate passive income and cash flow from your investments in the stock market.

Dividend stocks can be excellent investments that pay monthly so you can reach financial freedom.

It's possible to make $1,000 a month in dividends and some people even live off dividends.

With dividend stocks, you can reinvest your dividends to purchase more shares and grow your investment even faster.

Dividend stocks are a great way to make money while you sleep and achieve financial independence.

You can get started investing in dividend stocks with an app like M1 Finance which has no fees.

Bonds

Bonds are another investment that can provide a decent return on investment.

Depending on the type of bonds you choose, these can be much safer investments than stocks and real estate investments.

However, bonds tend to have lower returns than stocks – around 3% to 5% annually.

Bonds can be a great way to diversify your investment portfolio and reach your financial goals. Check out the video below to learn more about investing in bonds!

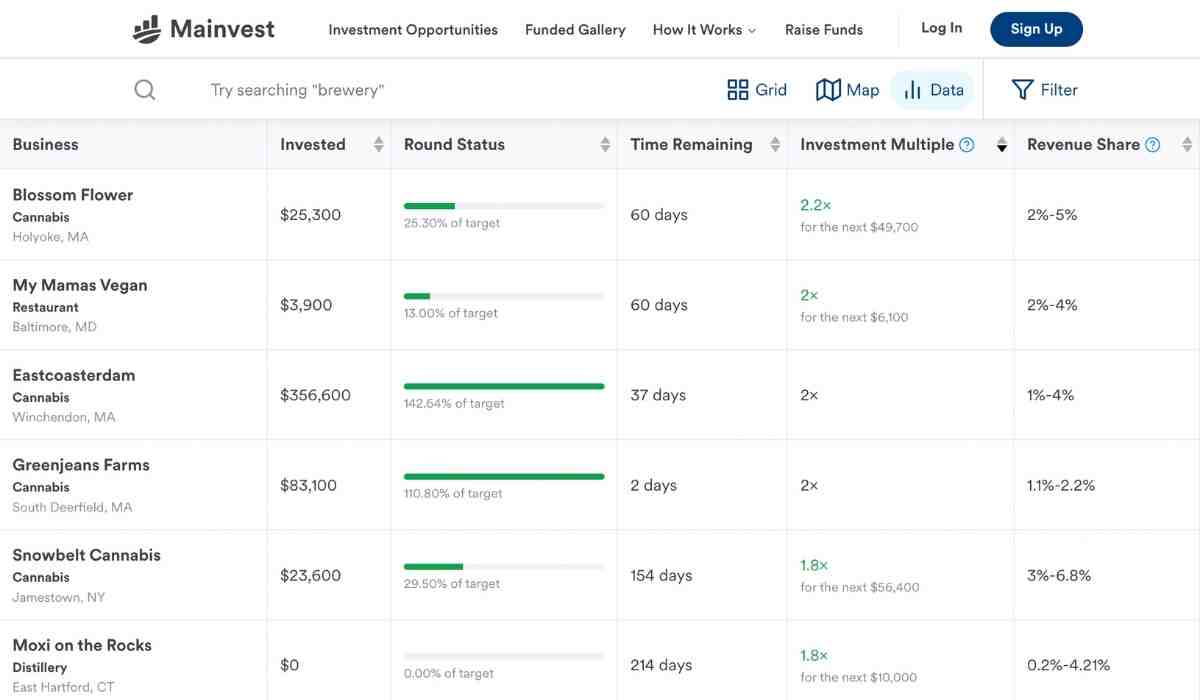

Invest in Small Businesses

Small businesses can be extremely profitable, however many investors don't have the time or energy to dedicate towards starting and growing a business.

That's where a platform like Mainvest comes in. Mainvest allows you to easily invest in small businesses across the country with as little as $100.

From restaurants to breweries, there are plenty of options to grow your money.

The target returns range from 10% to 25% annually (which is much larger than other investments). Create your free account here to start investing!

Invest in Cryptocurrency

Cryptocurrency can be an extremely profitable investment if you know what you're doing and choose.

The main thing to remember with cryptocurrency is that it's very volatile – meaning the price can go up or down with massive swings throughout the day.

This can be good or bad depending on when you invest and how much risk you're willing to take.

If you choose the right coin to invest in, you can make millions. However, if you choose the wrong coin you could lose money rapidly.

In general, I recommend sticking to more reputable coins like Bitcoin and Ethereum as these tend to be more stable than other “alt coins”.

If you're interested in cryptocurrency, I recommend investing with Binance. Binance makes investing in cryptocurrency simple and you can get started with just $10.

Invest in High Yield Savings Accounts

If you're looking for a safe investment to generate cash flow, using a high yield savings account is an easy way to earn interest on your money.

While you won't get rich from high yield savings accounts, it's a good way to make money that's essentially risk free.

My favorite account is through CIT Bank. You can earn 7 times as much as the national average in interest and you only need $100 to open an account.

To get started, simply create an account and deposit your money. Your money will then start earning interest immediately.

Invest in Retirement Accounts

Retirement accounts like an IRA or 401k can be tremendous methods to make more money and reduce your taxable income.

With an IRA, you can contribute up to $6,000 per year (or $7,000 if you're over 50).

With a 401k, you can contribute up to $19,000 per year (or $25,000 if you're over 50).

The great thing about a 401k is that you can often get a employer match – meaning if you contribute $5,000 to your 401k, your employer may contribute $5,000 as well.

This is essentially free money that can help you grow your retirement fund even faster.

You can open an IRA through M1 Finance – my favorite investing platform where you can get up to $250 free for new accounts.

Start Your Own Business

If you have $400,000 to invest, starting a business can be one option to grow your money.

However, this isn't for everyone. You'll want to be knowledgeable about how to start and grow a business before taking this route.

There are plenty of business ideas you can consider but I recommend low cost businesses that have a clear path to profitability.

For example, starting a pressure washing business is extremely simple, and it's not too difficult to start making money.

Whether you're looking to invest $150k or $400k, starting a business is a great option to consider.

How to Invest $400k for Income

If you're looking to generate cash flow from your investments, some of the best investments include:

- Real estate investing with Arrived, Realty Mogul, or EquityMultiple

- Dividend stock investing with M1 Finance

- Digital real estate investing

Don't worry – we hate spam too. Unsubscribe at any time.

What to do with $400k?

Depending on your risk tolerance, there are plenty of investments to consider.

But before investing your money, it's a good idea to consider your other financial situations.

For example, if you have high interest debt, you should almost always pay this off before investing.

Additionally, if you don't have an emergency fund setup – it's smart to save money in a savings account for unexpected expenses.

Once you have these basics in place, you can start thinking about how to grow your money with investments.

Final Thoughts on How to Invest $400k

There are plenty of options to invest your money and grow your wealth – no matter how much money you have.

The key is to find an investment that meets your needs and fits your risk tolerance.

Some of the best ways to invest your money include real estate investing with Realty Mogul, index funds with Acorns, and investing in small businesses with Mainvest.

Keeping your portfolio diversified is essential to lower risk and optimizing your returns.

Don't worry – we hate spam too. Unsubscribe at any time.