Do you have $60k to invest?

Investing wisely can be the difference between turning your $60,000 into hundreds of thousands of dollars (if not millions) or becoming broke. Yikes!

There are tons of different avenues you can take to invest $60k, but you have to do so wisely.

In this post, I'll explore the best ways to invest $60k, some tips to maximize your returns, and much more. Let's get started!

Best Way to Invest $60,000

1. Invest in Real Estate with Arrived

It's hard to go wrong with any kind of real estate investing and there are several different methods you can use to deploy your money in a tangible asset.

Crowdfunded real estate is one of the easiest ways to build wealth and turn your money into more money.

If you have $60k to invest, using a platform like Arrived is a tremendous option for a few reasons.

First, you don't need a fortune to get started. With Arrived you can invest in real estate with just $100.

Another reason I love Arrived is because you're investing in properties that tend to do better when inflation is high (like right now!).

Lastly, you get to pick and choose exactly what properties you invest in, so you have more control of your money compared to other crowdfunding options.

How much can you make?

Ultimately, it will depend on which properties you invest in, but it's not uncommon to see returns greater than 10% annually.

So if you want a flexible platform that's easy to use, open your account below!

2. Invest in Real Estate Debt

One of the least known real estate investment options is real estate debt.

This is where you're essentially lending money to real estate developers who use it to finance their projects.

For example, if a house flipper needs money to complete a flip, they'll often raise debt through a platform like GroundFloor so they can complete the project and make their money.

For investors, you can make great money on these short term debts. I've seen returns as high as 12% with real estate debt investments!

If you have $60,000 to invest, I would highly recommend checking out a platform like Groundfloor to invest a portion of your money.

3. Invest in Rental Properties

Rental properties can be among the most profitable investments you can make, even outside of real estate.

While they do require more work than some of the other options on this list, the returns can be incredible.

There are a few different ways to get started with rental properties but the most common is purchasing a rental property outright.

To do this, you'll need to have 20% for a down payment as well as the income to cover the mortgage payments.

This can be one of the best ways to make passive income and build long-term wealth because of the amount of ways you can make money.

For example, not only will you earn rental income from your tenants but you'll also benefit from appreciation if you purchase in the right market. Take a look at the average home sales price over the past decade.

This is just one of the ways you can make money by investing in rental properties.

As the property value rises, so does the amount you can charge for rent.

4. Invest in the Stock Market

The stock market is another great option for those looking to invest their money and earn passive income.

While there tends to be more risk involved with investing in the market, there is also the potential for larger returns.

Just like with some real estate investing apps, one benefit of investing in stocks is that you can start with a small amount of money.

For example, you can get started with as little as $5 on platforms like Acorns. As a bonus, you'll get $20 completely free.

There are numerous options to invest in the stock market, but some of the best include:

- Index funds

- Exchange traded funds (ETFs)

- Mutual funds

- Dividend stocks

- Growth stocks

The average returns of the stock market are around 7% but it's not uncommon to see returns in the double digits with a well-diversified portfolio.

When it comes to the stock market, it's important to keep your money invested for the long run.

Because the market fluctuates so much in the short term and you can lose more than you invest, it's important to hold onto your investments for at least a few years to see the best results and take advantage of the power of compounding returns.

For example, in the 2008 financial crisis, the stock market plummeted more than 50% from its highs. If you were only invested for the short term, you could have lost a fortune.

However, since 2008, the stock market has increased tremendously and you could have doubled your money in a few years.

So, if you want to invest $60k and you aren't sure where you should start, I highly recommend the stock market. Don't forget to claim your free $20 with Acorns below!

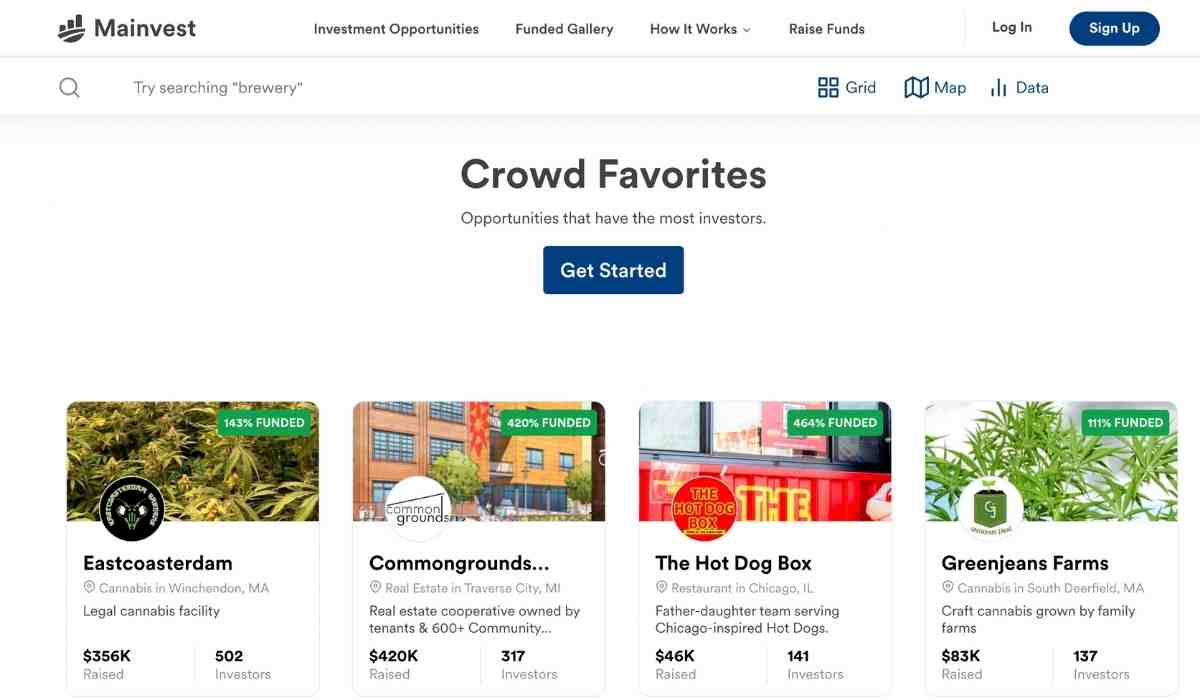

5. Invest in Small Businesses

Small businesses can be extremely profitable and a great option for investors looking to diversify your portfolio and increase their returns.

By using a platform like Mainvest you can start investing in small businesses with as little as $100.

There are a number of different types of small businesses you can invest in across the country from breweries to restaurants and many other types of businesses.

The returns for Mainvest vary depending on the business but it's possible to earn over 20% in some cases.

While there is more risk involved with investing in small businesses, the potential rewards are much higher which makes it a great option for those looking to invest their $60,000.

Invest in Cryptocurrency

Looking for an investment with massive potential returns?

Cryptocurrency could be worth considering adding to your portfolio as long as you're okay with more risk.

I've seen people make a fortune and lose a fortune by investing in various cryptocurrencies.

By investing in digital real estate like Bitcoin and Ethereum you can potentially see massive returns over time. Remember, these are never guaranteed – so I wouldn't put a ton of money in it.

You can use a platform like Binance to start buying and selling cryptocurrency today!

Retirement Accounts

Retirement accounts can be tremendous options for those looking for a place to invest their $60,000 for several reasons.

There are a number of different types of retirement accounts but some of the most popular include:

- 401k

- IRA

- Roth IRA

- SEP IRA

Each account has different rules and benefits so you'll want to take a look at the pros and cons before you get started.

One of the best things about retirement accounts is that they offer tax benefits so you can grow your money faster, without Uncle Sam taking nearly as much.

For example, with a 401k you'll get to contribute pre-tax dollars to invest which means your money will grow faster.

With a Roth IRA, you'll pay taxes on the money you contribute now, but all future withdrawals will be tax-free.

If you don't have any retirement accounts setup yet, this is your chance!

High Yield Savings Accounts

Looking for an extremely safe method to grow your money so you don't have to worry about it?

High yield savings accounts can be an easy account to generate interest without having to worry about potential losses.

Now, you're returns won't be anything crazy, but you can still generate a little money each month stashing your money away in one of these accounts.

One of my favorite accounts is through CIT Bank. You can generate as much as 8 times the national average in interest and you can open an account with just $100.

Open your free CIT Bank account below to get started!

Bonds

If you need another safe method to invest $60,000 – bonds should be on your list.

You can think of bonds as a small loan in exchange for interest payments.

These can be to business or the government.

For example, corporate bonds are loans to businesses who might need money for some reason or another.

The interest rate you will receive will depend on the creditworthiness of the borrower. For example, if you purchase a government bond, you're essentially betting the government will be able to pay you back. These are extremely low risk.

However, if you purchase a corporate bond from a lesser known company that is facing a cash crunch, this can be much more risky.

There is a balance of risk and reward you should consider when investing in bonds. Want to play it safe? Go with government or treasury bonds. Looking to maximize returns? Go with a corporate bond.

Check out the video below to learn how you can invest in bonds!

Alternative Investments

There are many different alternative investments that you can consider if you're looking to invest $60k.

Some of the most popular alternative investments include:

- Artwork

- Fine wines

- Collectibles

Investing in alternative assets is a great way to diversify your portfolio and potentially earn a higher return on your investment.

But they can also be more risky. Just like other speculative assets, I wouldn't invest all of my money into alternative assets.

How to Invest $60k in Real Estate

If you want to invest $60k strictly in real estate, some of the best methods include:

- Crowdfunded real estate with Realty Mogul

- Commercial real estate with EquityMultiple

- Real estate debt with Groundfloor

- Rental properties

Don't worry – we hate spam too. Unsubscribe at any time.

Things to Keep in Mind When Investing

How much risk are you willing to take?

Those who are younger and aren't going to need the money for a while can afford to take on more risk.

On the other hand, if you're nearing retirement or need the money soon – you'll want to be more conservative with your investments.

For those who don't want to take much risk, it's better to stick to more conservative investments like bonds and high yield savings accounts.

If you're willing to take more risk, investing in small businesses with Mainvest could be a perfect way to maximize your returns.

What are your goals?

Are you trying to turn $10k into $100k? Or $60k into $1 million?

Depending on your goals, your investing strategy will need to adapt and change.

Those seeking larger returns will need to be willing to take on more risk.

Do you have debt?

Debt like credit card debt, student loans, and some personal loans can cost you a fortune in interest payments.

Before you start investing, it's important to get rid of high-interest debt first.

Not only will this free up more money to invest, but it will also allow you to invest with less risk.

Final Thoughts on How to Invest $60k

There are many different investment opportunities if you have $60,000 to invest and you need to be careful to avoid losing money.

The best way to grow your wealth is to invest in a diversified mix of assets that have the potential to generate high returns.

I recommend using platforms like Realty Mogul and Acorns to get started with investing in both real estate and the stock market.

Don't worry – we hate spam too. Unsubscribe at any time.