Obtaining a college degree has become a social norm that may, or may not, be worth it in 2021. It comes with a tremendous amount of time and (most likely) debt that can take years to pay off. After you meet the qualifications, you’ll receive a piece of paper that indicates you completed a group of courses slightly related to the job duties of your field. You are not guaranteed a job, and wage growth for employees has slowed while the costs of college are rising quickly.

The amount of debt American’s owe thanks to their further education now topples more than $1.5 trillion… With a “t”. That amounts to almost 10% of the entire United States Federal debt. And for what? School.

So is it worth it? Or is college a waste of time and money?

In this post, we’ll discuss everything you should consider before enrolling in college, different alternatives for college, some tips to help you succeed during your college years, and ultimately if college is a waste of time or whether it's a good investment.

College can be what you make of it. For some, it can provide unbelievable returns and years of prosperity while others might be crippled by the financial burdens of student loans. Let's get started.

Is College Necessary?

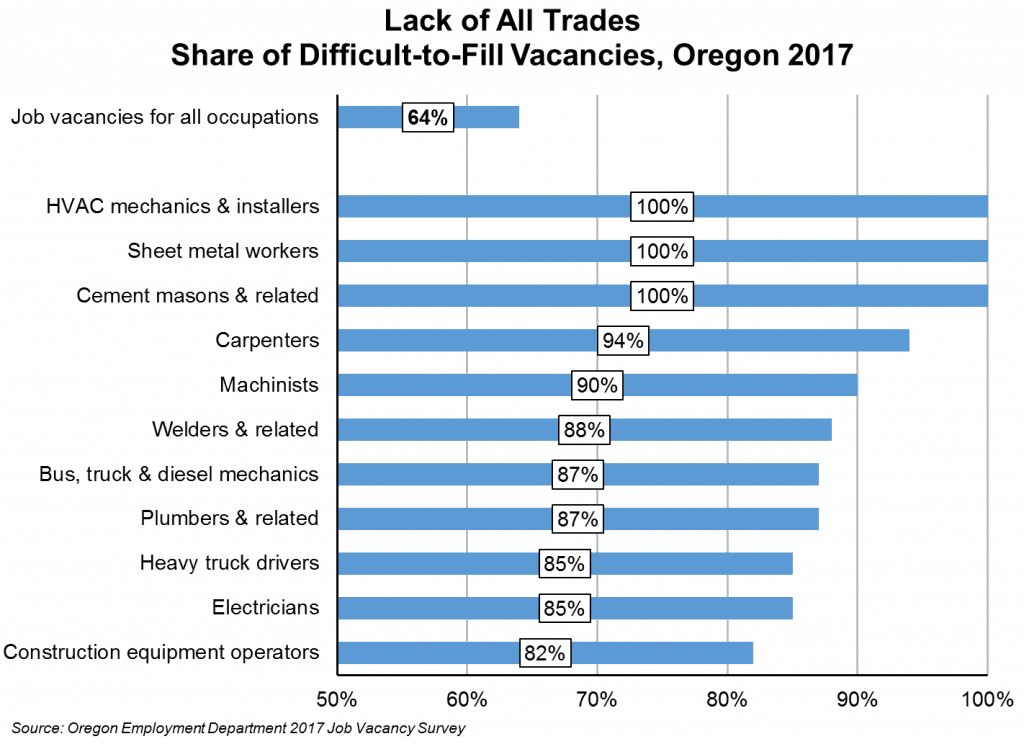

Although college has become a social norm for many, the demand for people in trades is at an all-time high.

But there are still many reasons to go to college. A college graduate will typically earn 74.5% more than those only holding a high school diploma.

When deciding if college is right for you, you need to ask yourself a few questions.

- Does my degree offer a career with growth potential?

- Will I have to take on an enormous amount of debt to fund my education?

- Do I have the time to dedicate towards school?

- Why am I planning on attending college?

If you are closing a major that does not offer great earnings potential, you might want to reconsider your trip to college. This does not mean you shouldn’t attend, but instead, you should create a plan to secure a job and enhance your earnings after college.

Do you plan on taking out student loans to fund your education? Once again, this doesn’t disqualify you from attending college, but it would be wise to find alternative methods of funding your education like scholarships or grants. (More on this below!)

If you don’t have the time necessary to attend college both in and out of class, there’s a good chance you might be throwing your money down the drain. Ensure that you can dedicate the appropriate amount of time towards your education to make a good decision.

Everyone attends college for their own reasons. Maybe it’s to get a job with strong earnings potential. Maybe it’s to have a positive impact on the world using the skills you acquire. Or maybe it’s because, well, your parents expect you to go. The last is a recipe for failure. You should have a good reason for attending college and if not, you may want to rethink your decision.

Careers That Don’t Require Degree

There are many different options for those without a college degree. Some of which might even pay more than a typical job held by a college graduate. You can oftentimes land in a career with only an Associates' degree, which costs significantly less than a full four-year college degree. Below are some of the best career paths for those without a bachelor's degree.

- Software Engineer or Computer Programmer

- Radiology Technician

- Pharmacy Technician

- Warehouse Supervisor

- Air Traffic Controller

- Pilot

- Dental Hygienist

- Real Estate Agent

College Alternatives to Save Money

Obtaining a bachelor's degree is not your only opportunity to pursue further education after high school. There are many other options you can consider.

Trade schools, community colleges, cosmetology school, online degrees, or even developing skills on your own are all viable options to land a job once completed. Some of these opportunities also come with a cost, so be sure to keep that in mind when choosing which is right for you.

Don't worry – we hate spam too. Unsubscribe at any time.

How Much is the Financial Cost of College?

Unfortunately, the costs of college aren’t limited to tuition. There are many other costs that you should factor into your equation when determining whether or not college is right for you.

College Admission Fees

Before you can even attend university, you must be accepted by the school. This requires you to take some sort of standardized test to prove you have the knowledge to succeed in college. These tests, most commonly the ACT and SAT, are not free. Each will set you back around $50 to take the test, but many will decide to take it multiple times to better their chance of getting accepted into their desired school.

Most universities will also charge an application fee when you decide to apply. These can range anywhere from $50 to several hundred dollars depending on the school and are typically nonrefundable.

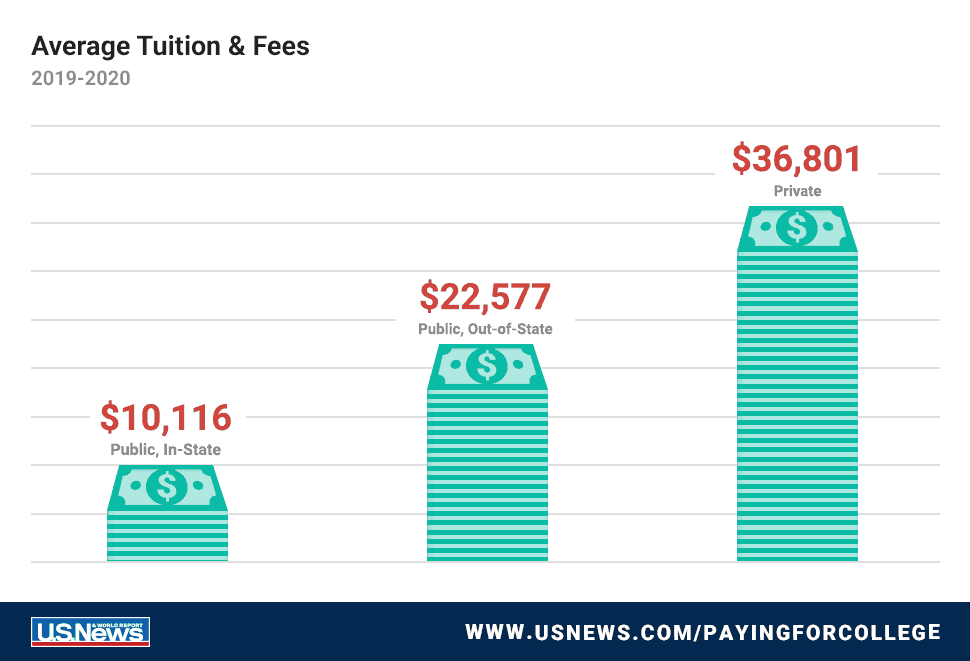

How Much Does Tuition Cost?

How much college will cost you depends on many different factors. Did you get any scholarship money? Are you planning on attending a private or public school? What kind of degree are you pursuing? All of these factors will determine how much school will cost you.

You can expect to pay anywhere from $2,000 to $20,000 per semester in tuition costs, depending on your school. For a typical public university, this will amount to roughly $48,000 for your four-year tenor to obtain a Bachelor’s degree.

If you plan on attending a college that is out of state, you can plan to spend even more. Oftentimes out of state tuition can cost double the total of in-state tuition.

Cost of College Living Expenses

The costs of college go beyond tuition. If your college is not local and you do not have the luxury of living at home, you’ll need to account for any living expenses that might come with living on your own. This means rent, utilities, and many other costs that can quickly add up.

Another option that many students chose is to live on campus in the school's dormitories. This can easily add another $20,000+ to your bill when the time comes.

The amenities of living on campus can be plentiful, but are they worth it? There are two main benefits of living on campus.

1. Social & Networking Benefits

One of the top reasons many students chose to live on campus is to take advantage of networking opportunities and meeting new people. To be honest, this is a valid reason to live on campus, but you must determine if this alone is worth $20,000 or if this is something you can do while living away from campus.

You’ll be given the opportunity to connect with other students living on campus and you’ll easily be able to participate in extra circular activities.

2. Time

The second reason students will live on campus is to save time. All of the time you spend commuting to and from class can be cut down dramatically by living on campus. Is this worth it to you? Depending on your circumstances, it could be.

Books and Learning Materials

Picture this, you’ve just found your way to your first collegiate class. You get to class, sit down in your seat, only to realize you don’t have the required book for the class. You go online, and probably make your way to Amazon, only to find out the book is going to cost you $350. For one book. Rent is due next week, and you won’t get paid from your job until the following week. What will you do?

The costs of textbooks and school supplies has risen dramatically over recent years. Between computers, graphing calculators, textbooks, and other scholastic necessities, you can end up spending thousands on school supplies per semester.

Transportation Costs

If you plan to live off-campus, you’ll need to account for any transportation expenses to get to and from class. Even if you live relatively close to your university, between gas and car maintenance costs, you should account for them in your decision.

If you’re attending a college out of state, you should also consider the costs of travel to and from school. Whether it’s to visit family or enjoy your holiday breaks, be sure to add these costs to your total.

How to Lower the Financial Cost of College

Once you’ve determined the financial costs of college, you’ll probably be on the lookout for ways to cut back and save money so you don't waste your time.

Earn a Scholarship

One of the best ways to lower the cost of college is to earn a scholarship. There are literally thousands of scholarships available for many different scenarios, so you should aim to apply to several that suit your skills. The financial benefits for scholarships range from a few hundred dollars to a completely funded education.

Live at Home

Another way to save money when attending college is to live at home. That’s right, with your family. It certainly isn’t the sexy option, but it can easily save you $500+ per month on living expenses if the opportunity is available.

Finish on Time (But Please Finish!)

There are countless stories of how long it takes some students to complete college ranging from 3 to 10+ years. And while you should still celebrate your accomplishment, you should aim to complete your program on time, or ahead of schedule to save money. You can take an extra course each semester to decrease the length of your degree by a semester, saving you thousands.

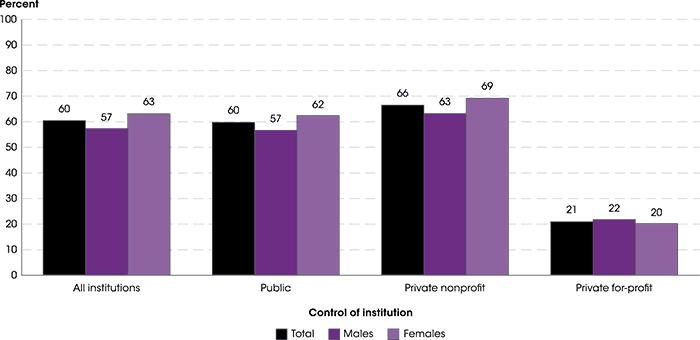

Roughly 60% of college attendees will ever walk across the stage to receive their diploma among four-year public universities. What does this mean for the 40% who don’t? Plenty of student loans, with nothing to show for them. Completing college should be your priority while attending to avoid this financial catastrophe.

Buy Supplies Online

Want a way to legally print money? Open a college bookstore! These stores mark up their items exponentially and make tremendous profits. Instead, try purchasing your books and supplies online to save money. Sometimes you may be required to purchase your textbook through the bookstore, so be sure to check beforehand.

You can also consider purchasing your textbooks used to save money. Sometimes you can even purchase previous versions of the book to lower your costs (although it’s important to double-check with your professor as some books can be much different in the latest version).

Pick a Low-Cost School

This one might seem obvious but is probably the easiest way to lower your education costs. Tuition varies greatly from school to school, so instead of opting for a private university look for more viable options like a public university that is in state.

You can also consider attending a community college for your first few years before transferring to a public university to finish your degree. The perks of doing this are that you will save thousands in tuition costs while still obtaining a degree from a public university.

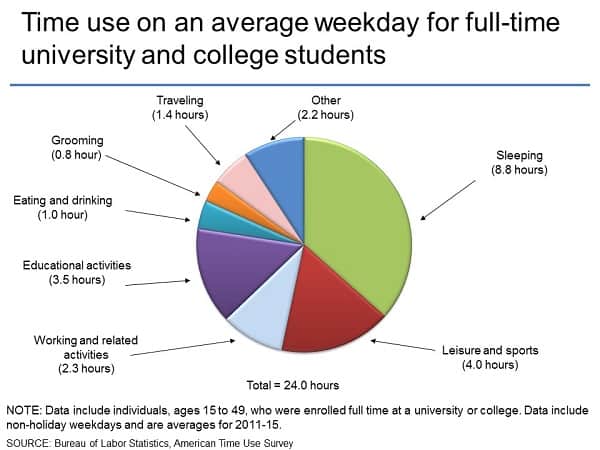

How Much Time will College Require

The amount of time that you will spend on college will ultimately depend on how much time you want to spend. For undergraduate degrees, it is common to spend 2-3 hours outside of class preparing and studying for that class. For graduate programs, you can expect to spend even more time outside of class on your studies.

This means that you can expect to spend anywhere from 30-45 hours per week on class if you take 15 credit hours.

There’s also time outside of class or schoolwork that you will spend at college whether it’s networking, a job, or other social activities.

Related: Is a Business Degree Worth It?

Homework & Studying

Homework and studying will require the largest amount of time outside of normal class hours. When you begin a class your professor should give you a good idea of how much work is required.

Networking

If you plan to attend college, you need to network. In fact, some will argue that your networking opportunities are worth more than your actual degree. This means that you should aim to meet new people and dedicate time to do so.

If you want to make college worth the time and money, networking is vital.

How Do Student Loan Repayment Plans Work?

Whenever you decide to attend college, you’ll need to have a plan in place to pay for your education. For many, it ends up being a combination of subsidized and unsubsidized loans. These loans can have interest rates of anywhere from 4.5% to almost 10% and they start accruing interest from the day you sign your name and your loan is initiated.

Once you graduate from your university, your student loans will come with a 6 month grace period in which you are not mandated to make payments. This time is allowed to give you time to find a job, making repaying your student loans more realistic.

Your 6 month grace period is optional. It is advised that you start paying your student loans as soon as possible to avoid unnecessary interest payments.

When it comes to paying your student loans, each loan could have different terms. More specifically, federal loans will have much different terms than private loans. You should always review the details of your loan to prioritize those that are more costly.

Standard Repayment Plan

A standard student loan repayment plan will abide by the terms of your initial loan and will include a fixed payment. They are commonly 10 years in length and interest rates vary but are commonly around 5% for undergraduate programs.

Extended Repayment Plans

If you cannot afford your standard repayment plan, you can also opt for an extended repayment plan. This will effectively increase the duration of your loan, making your payments less costly, but you will end up paying for much longer.

Not everyone is eligible for extended repayment plans, so be sure to check your eligibility before planning on this repayment structure.

By extending the duration of your loans, you will drastically increase the amount of student loan interest you will pay. We do not recommend extending your payment plan unless extreme circumstances prevail.

Income-Based Repayment

Similar to an extended repayment plan, an income-based repayment plan will put a cap on your monthly payments that is decided by your current income. There are several different options when it comes to income-based repayment plans that you can learn about here, each with there own advantages and disadvantages.

The main advantage of income-based repayment plans is that it gives those who do make enough money to cover their student loan payments an option to avoid any penalties or fees that might come with it.

REMEMBER: Just because your repayment plan is income-based doesn’t mean it won’t rack up interest the longer it takes you to pay.

Should I Work in College?

Now that you know the costs of college, it leaves many with no other option than to pick up a job to help them stay afloat financially. You should aim to find a job that is flexible with your schedule and allows you to make your education a priority.

You can often find jobs at your school that will offer these benefits and more. Jobs like tutoring, internships, and driving for a ride-hailing service make great candidates to keep your bills paid and your refrigerator stocked.

Because work can be so time-consuming, you might want to try these passive income ideas perfect for students. This is an excellent way to put your money to work for you. If you're thinking “I need money desperately“, try checking out some of these ways to make money.

Indirect Benefits of College

While gaining an education is the primary benefit of going to college, there are also secondary benefits. Below, I'll explore several benefits you might have ignored before deciding whether college is a waste of time or worth it.

Enhanced Social and Communication Skills

When you enter the workforce, some skills are more valuable than others and are applicable across all careers and industries. Social skills and communication are one of these.

No matter what job you work, having enhanced social skills will surely work for your benefit out of college.

Developing Independent Living Skills

If you choose to live on campus during your college career this can help you to learn how to live own your own. While you might think these skills are obvious, college can be a wakeup call for many who rely on parents and guardians to help them stay on track with daily routines.

Increased Accountability

The majority of college students will attend immediately after graduating from high school. This is a critical time in their life in which they are just fulling becoming an adult. With adulthood comes increased accountability and college can help to develop it.

Is College a Waste of Time and Money?

College is simply not for everyone. To determine whether it’s a waste of time, you’ll need to consider many factors.

It’s all about opportunity costs. What would you be doing if you didn’t go to college? If the answer is sitting on the couch watching television, college is not a waste of time. However, if you are planning on using your time to develop your skills that can produce more income than a college degree, college could be a waste of time and money.

For the majority of people, college is worth the investment. It may take some time to pay off, but for most, it will.

Why People Make Poor Decisions When it Comes to College

The number one reason people make poor decisions when it comes to deciding whether to attend college is the lack of awareness and knowledge.

For many, they might research how much the tuition is for their desired college, but disregard the many other costs that come with it. This leads to financial stress that could force them to abandon college while still racking up thousands of dollars in student debt.

Know the costs involved in order to make a wise decision that will impact your future for years to come.

The second reason people make poor decisions regarding their furthered education is social pressures.

For many people college can be a waste of time but because of pressure from friends, family, and the general population, they choose to attend college in hopes of finding a job soon after. This can lead to an unsatisfactory career and mental health issues down the road that could have otherwise been avoided.

How to Make College Worth Your Time and Money

When you’ve analyzed all of the pros and cons of college, and you’ve made your decision to attend, you need to make it worth your investment. If you just show up to class, limit your time outside of class, and disregard networking opportunities, college might not be worth your time.

We’ve put together a list of things you should do to make college worth your time and money!

Attend Class (Even on the rough days)

Once you get to college, you’ll quickly learn that for many classes, attendance is not required. After a long night, you might be tempted to skip class and sleep in instead.

You’re paying for each hour of class, so you should attend! If you were given the amount you paid for each time you went to class, you’d probably attend each and every one. Why is it any different?

Don’t Just Attend, Participate!

If you show up to class only to play on your phone or browse social media, stay home. It’s not worth your time. You need to make sure you actively participate in class to get the most out of it. This means asking and answering questions, helping others, and taking notes.

Study More than You Think

Your studies don’t end when class is over. You need to dedicate time to your studies outside of normal class time. This is what will help you to develop skills and truly learn. If you run into any problems or questions, this is what class time is for.

To be successful in college, you should try to study more than you think. More often than not, over-preparation is worth your time and can help you achieve the grade you’re looking for.

Take Advantage of Networking Opportunities

Just as mentioned above, you can easily make your college experience worthwhile by meeting new people and fostering relationships. You never know when these relationships might come in handy (HINT: your next job interview or promotion opportunity).

How Hard is College?

College is not easy for most. It is designed to challenge and develop many different skills, preparing you for the workforce.

Some schools are more stringent than others when it comes to performance evaluations and grading. You can expect for an Ivy League school to require the highest level of intelligence while a community college will have lower standards.

Stats About College and Income

- According to the US Bureau Labor of Statistics, those with a high school diploma have an unemployment rate of 4.6%, those with a Bachelor’s degree have an unemployment rate of 2.5%.

- There are over 30 million jobs in the US that pay $55,000 or more not requiring a college degree.

- Roughly 60% of students will graduate from a 4-year public university within 6 years of attending.

Final Thoughts on If College is a Waste of Time and Money

College is a big and costly decision. It can quite literally be a $100,000+ decision that is typically made when you are less than 20 years of age, making mishaps extremely common. You need to analyze the true cost of college before you make any decision on whether it is right for you or if it might be a waste of time.

If you lack the resources required to succeed in college, you might want to reconsider your decision as it can end up cost you tens of thousands of dollars and a lifetime of interest payments. There are many other options for those who find college may not be the best path for them such as a trade school or an online degree.

If planning to attend college, you should do so for reasons that benefit your future, not because it is “expected”. If your education is financed, you should aim to pay off your student debt as soon as possible to limit the amount of interest paid.

How was your college experience? Did it benefit your future? Comment below!

Don't worry – we hate spam too. Unsubscribe at any time.