If you're in the market for a budgeting app to help you stay on top of your finances, Truebill and Mint are two of the heavy hitters on the market you've probably heard of.

Both apps offer a variety of features to help you save money and keep more of your hard earned income.

But which one is better and what are the key differences?

In this post, I'll explore Truebill vs Mint, the main differences between the personal finance apps, and much more. Let's get started!

What Are The Advantages Of Budgeting Apps?

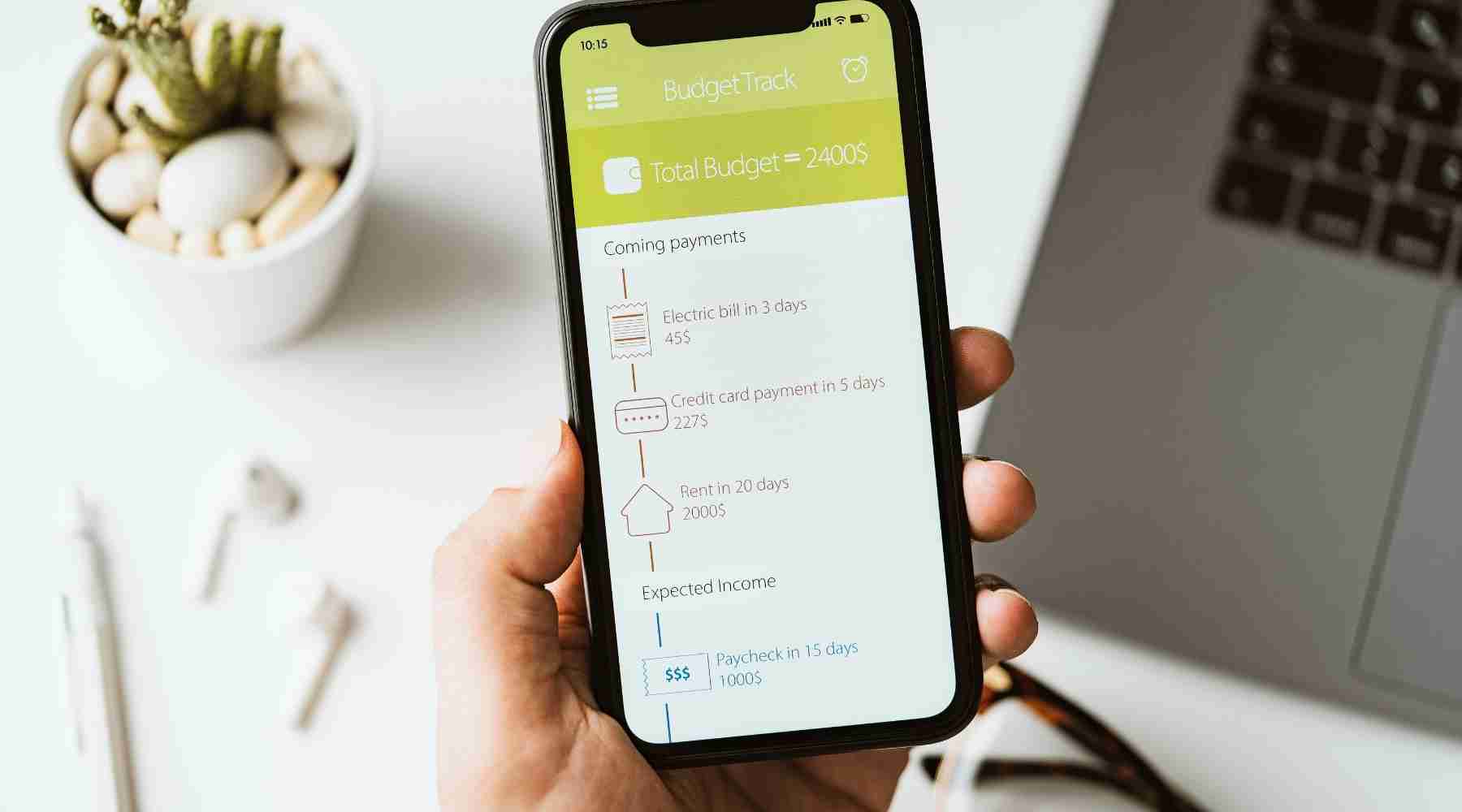

Budgeting apps generally help with two different things.

One is that they help you monitor your bank accounts and keep track of how much money you have. The best budget apps help you monitor your financial health, and can help track all your money.

The other thing budgeting apps can help with is your spending habits.

Budgeting apps help you keep track of your expenses, where your money is going, and make suggestions to help improve your financial health.

Because a lot of the best budgeting apps are free, they're a great option for people who want to save money but don't want to pay for other financial services.

Another big advantage of using a budgeting app is that you'll be able to keep track of all your financial accounts and all your spending habits in one location.

Having everything collected in one app also saves time since it won't take nearly as long to look everything over.

Related Resources:

- 70 Cheapest Foods & Meal Ideas to Save Money

- 12 Cheapest Way to Live & Housing Alternatives

- How to Live Mortgage Free and Save Money

- Best Frugal Living Tips from the Great Depression

Truebill Vs. Mint: Which Is Right For You?

Truebill and Mint are both considered some of the best budgeting apps available right now, which can make choosing between them more difficult.

When it comes to Truebill vs Mint there might not be one app that's better than the other, instead, each app is better for addressing different financial needs.

Here's what you need to know to decide between Truebill vs Mint and which option is better for you.

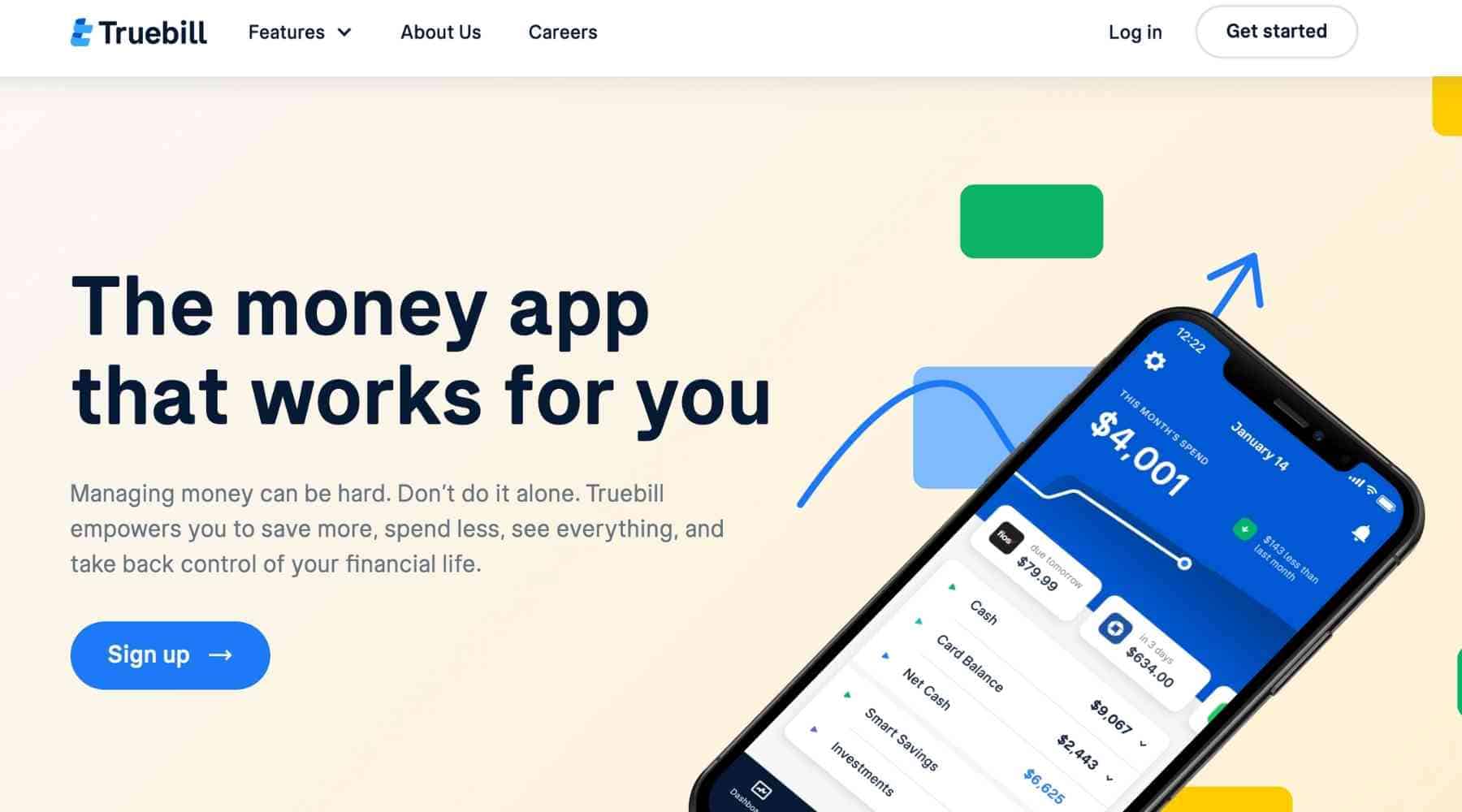

How Truebill Works

Truebill is a great budgeting app that helps users save money in a variety of ways.

One of the main differences between Truebill and Mint is that Truebill is more focused on helping users save money and meet their long-term savings goals.

Once you've linked Truebill to your bank account the app detects monthly bills and other spending. It helps detect subscriptions, personal spending, and create monthly budgets based on the money you have and how much you're currently spending.

One of the most unique features of Truebill is that it tracks all the subscriptions you're currently paying. That way it can recommend dropping unnecessary subscriptions or help you find subscriptions you thought you'd canceled.

Another unique feature is that Truebill offers bill negotiation services.

Bill negotiation is a premium feature of Truebill, and the app will keep 40% of any savings they negotiate from your bills.

Bill negotiation services make Truebill one of the very few budget apps that can actively help users save money and improve their credit scores. By lowering the amount of money coming out of your accounts every month you'll be able to increase your savings, pay off personal loans and credit cards faster, and use financial planning to improve all your finances.

If the free version isn't powerful enough, users also have the option of updating to the paid version, Truebill Premium.

Truebill Premium allows users to create unlimited budgets, and gives you access to concierge services. That way you can have someone else call to cancel subscriptions or negotiate bills. The concierge also automatically asks for refunds on your behalf, to make sure you're getting as much money as possible.

Truebill is a tremendous personal finance app that I highly recommend to anyone who wants to save money and budget better.

Does Truebill Really Help Lower Your Bills?

Truebill's bill negotiation service is very real and can be very effective.

While some bills may not be negotiable, like your rent to your landlord, many other bills and services are. Truebill will attempt to lower your bills as much as they can so you can make the most of your monthly income.

Truthfully not every user will benefit from this service. But, since you'll only need to pay Trubill for its bill negotiation service if they succeed in lowering your bills, there's no reason not to try.

Is There A Better App Than Truebill For Saving Money?

Truebill and Mint are both considered some of the best apps for creating monthly budgets and building good spending habits to meet your savings goals. However, that doesn't mean that Truebill is the best app for everyone.

However, I personally prefer using Truebill because of it's money saving features that other competitors lack.

Sign up for Truebill here to get started saving money automatically!

Can You Trust Truebill?

Truebill is one of the more trustworthy apps for meeting your financial goals. They have been around since 2006 and have a solid history of helping people save money.

The app uses bank-level information encryption to help keep all transactions safe. The company's servers don't store any accessible personal information, and anything they do keep to help with budgeting is carefully encrypted for better security.

That makes Truebill a fantastic option and is one of the reasons Truebill is considered a best free budgeting app by so many.

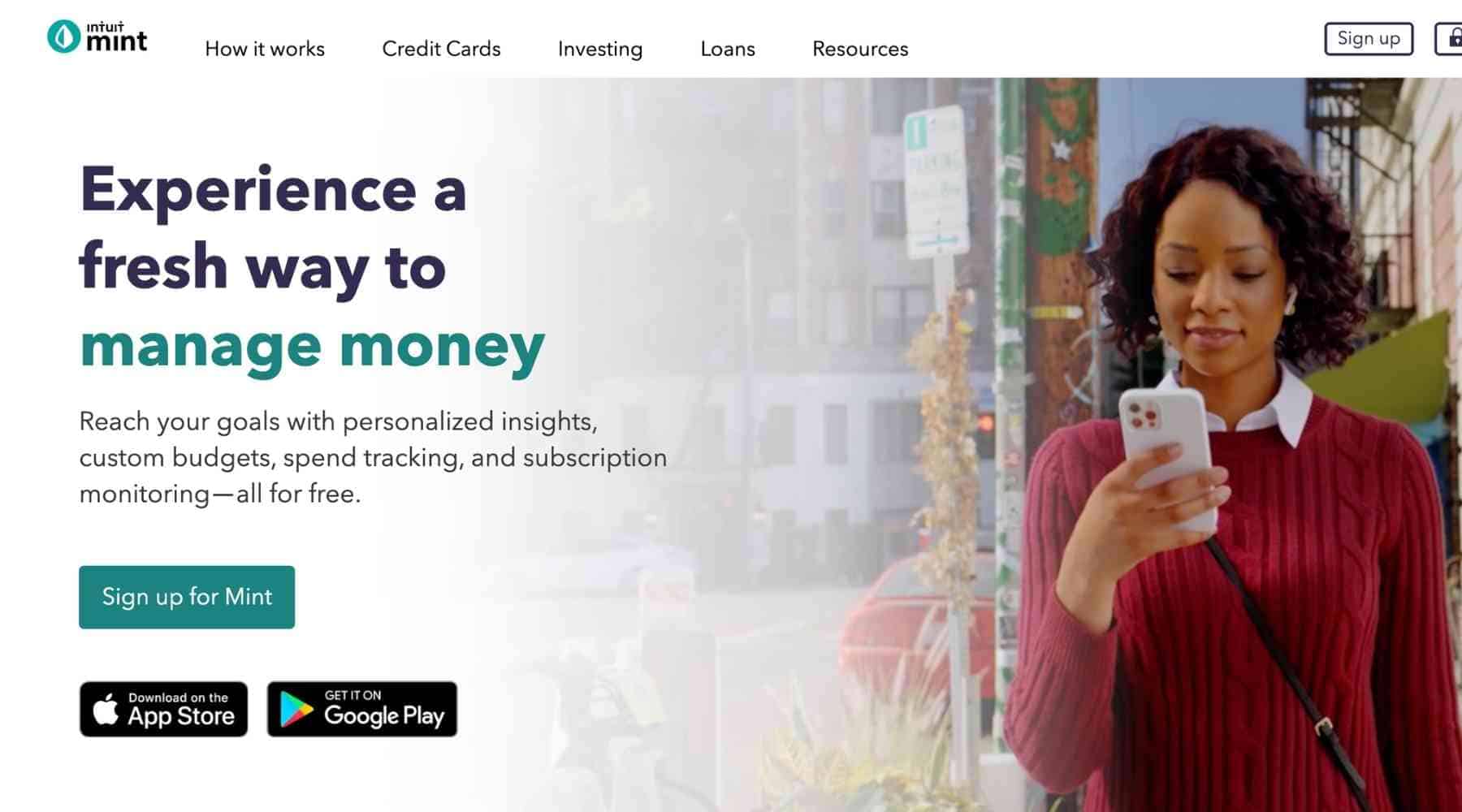

How Mint Works

Mint was published by Intuit and is designed to help users create an effective personal budget and change financial habits to meet their goals.

The Mint app has a lot of features to help you keep track of all your financial accounts, and is consistently rated one of the best free budgeting apps despite being completely free.

Mint's interface allows users to create a customized budget based on their current income and bills. Included budgeting tools make it easier to track your financial needs, savings, and see how small adjustments can help your finances.

You'll also be able to track monthly bills, investment accounts, and other costs and assets inside Mint.

The app helps track spending in real-time. Like most of the best money management apps, Mint helps keep track of your savings accounts as well as your credit cards and checking accounts.

As an added bonus, Mint makes it easy to check your credit score and see why your score is going up or down. Your credit score on Mint is also highly accurate and stays up to date so you'll know about any changes right away.

While Mint doesn't immediately start recommending ways to save, going to the ways to save tab in the app can be a great way to learn new ways to save.

Mint is specifically designed to suggest savings options that are doable and reasonable with your current financing, not blanket advice that doesn't apply to your monthly budgets.

Are There Any Apps Better Than Mint For Saving Money?

Mint is one of the best personal finance apps since it takes into account your entire financial life, including multiple bank accounts, monthly budgets, and recurring bills. If you have financial goals or want an easier way to access your credit report, Mint can help.

But if those aren't the reasons you want a personal finance app you may want to consider a different option. Mint is one of the best budgeting tools for some users, but it's not for everyone.

For instance, Truebill might be better if you're looking for a service that actively helps you save money and manage your personal finances.

If you're looking to save money by getting discounts or earning cash back on purchases, you might want to look into an app like Acorns or Ibotta.

For pure financial tracking, without the other advantages of Mint, PocketGuard might be a good option.

None of these apps are necessarily better than Mint, but they are all specialized for different financial services.

Can You Trust Mint?

Mint is an incredibly trustworthy free budget app. Since it was published by a financial institution, Intuit, you can trust that it follows the same rules and regulations as financial institutions.

It's safe to link Mint to your bank accounts and to look up your credit score. The Mint app doesn't track your personal information and all of your financial details are private and protected.

When it comes to a free app budgeting tool, privacy doesn't get much better than Mint.

Features Both Apps Have In Common

Truebill and Mint might be very different apps, but both budgeting apps excel in some of the same areas.

Budgeting Services

For instance, both Truebill and Mint are designed to make budgeting easier. They allow you to create custom budgets to improve your money management skills.

Both Truebill and Mint also provide a range of spending categories so you can see where your money is going. For instance, services like Audible, Hulu, and Netflix might all get grouped together as entertainment costs, while grocery bills and trips to restaurants are considered food costs.

That way you can see how you're spending your money, and whether that spending supports your financial goals.

Both apps also let you create theoretical budgets, where you shift your spending slightly and see how much that affects your finished budget.

Financial Tracking Services

Both Truebill and Mint also offer a range of tracking services so you can monitor your spending in real-time. They display your account balances, recent transactions, and other details about your financial bank accounts so you always know where you stand.

Both apps are effective for tracking multiple bank accounts or credit cards. You can also link multiple banks to both apps, so you aren't limited to working with a single bank or credit institution.

Savings Features

When it comes to savings features, Truebill and Mint are fairly comparable. Both let you set savings goals and create budgets designed to meet those goals. Both encourage savings and advise that you have at least a little money set aside for savings every month.

Since both are designed to support your savings goals, both are equally well suited to people that want to create a safety net, or who are saving up for a big investment.

Related: Best Ways to Save $10,000 in a Year

Differences Between Truebill And Mint

Of course, like any good apps, there are some serious differences between Truebill and Mint. Here's what you need to know to choose which of these money-saving apps is right for you.

Desktop Interface

One of the biggest differences is in how you access the apps. Both Truebill and Mint have good mobile apps with lots of features and functionality. However, when it comes to the Desktop interface these two are fairly different.

Mint's desktop app is very similar to its mobile interface. There are lots of features, and navigating is fairly intuitive and easy to get used to.

Truebill, on the other hand, doesn't have nearly as many features in its desktop version. You'll be able to check on your finances and look at your monthly spreadsheets in the desktop version, but not much more. Even basic things like your bank account details are saved for the mobile app instead of the desktop version.

Bill Services

We've already talked a little about this, but it's worth pointing out the difference specifically. While Truebill and Mint both help with budgeting and creating good financial habits, only one of these apps can actually help you lower your monthly expenses in-app.

Truebill makes canceling subscriptions simple. They also offer bills negotiation services to find out if there are ways to get the same or similar services for less than you're already paying. Truebill keeps a portion of the savings when they do this, but since users keep the majority it's still a useful part of the app.

Mint, however, doesn't offer any direct money savings services. They might offer some saving suggestions, but you have to take action on your own. The app won't do anything to change your monthly expenses directly.

Saving Suggestions

Another key difference is how the two apps present savings suggestions.

Truebill highlights items you may want to consider canceling, like subscriptions you don't need or that you've already duplicated. That makes it easier to find ways to save money and meet your goals.

Mint does have some similar savings suggestions, but they're kept on a different tab of the app. You have to be specifically looking for savings help to access these suggestions, and the app won't handle any of the transactions itself.

Savings Opportunities

Savings suggestions and saving opportunities are two very different things. A suggestion helps users find ways to cut their expenses, while opportunities may help your finances through improved offers or access to limited deals.

While Truebill might make saving suggestions easier, Mint provides plenty of savings opportunities to users.

For instance, Mint users can browse a wide library of exclusive offers for investment accounts, personal loans, credit card accounts, and insurance offers.

That can make Mint a better offer for people who have a little more money available to take advantage of those offerings, though Truebill does have a more limited selection of similar offers.

Paid Features and Premium Services

Another important difference between the two apps is whether you need to pay for any of the services. While Truebill charges a 40% of savings fee on bill negotiations and has a paid premium version, Mint is 100% free.

That doesn't always mean that Mint is the better financial option, after all, most users think that Truebill's paid services are well worth the cost. But it does mean that users who are looking for a 100% free app may be happier with Mint's services, while users who are looking for more customer service and direct app services may be happier with Truebill.

Related Reading:

- Why Am I Broke? [And How to Stop Being Broke]

- 13 Emergency Fund Examples & How Much to Save

- Frugal vs Cheap: What's the Difference?

Don't worry – we hate spam too. Unsubscribe at any time.

How To Choose The Right Budgeting App For You

Knowing about different budgeting apps and choosing the right app for you are often two different things. Here are some things to consider when you're trying to decide which budgeting app is the best fit, whether you're considering Truebill, Mint, or a different app entirely.

What Is Your Financial Priority?

There are a lot of different priorities you can have for your finances. Knowing which one is most important to you is critical if you want to choose the right app.

Making Affordable Investments

If you're looking for an app that can help you build an investment portfolio, you probably need something very different from a budgeting or savings app. Look for something designed for small-time traders and that offers a lot of tools for monitoring and trading on the stock market.

Building Your Savings

Truebill and Mint are both good choices if one of your primary goals is learning how to save more money. These apps help you identify your spending and make it easier to find spare money you can start saving instead of spending.

Learn To Budget

Budgeting doesn't come naturally to many of us. If you're looking for a tool that will help you learn how to budget effectively, tools like Mint and Truebill are great choices. There are some other budgeting apps that are similarly effective, and others that are slimmed down to just the budgeting options.

Curb Your Spending

Truebill is one of the better apps if you're looking for a financial app that can help you curb your spending and stay on track a little better. Its spending categories and other financial tools make it easier to keep track of where your money is going and helps find the small adjustments that will make the biggest difference.

How Much Time Do You Have?

Some apps are designed to be more helpful than others, but they can take a lot of extra time to use properly. If you don't have a lot of time for your finances it might be a good idea to look for a less extensive app since it won't take as much time to use those apps effectively.

Do You Prefer To Use A Mobile Or A Desktop App?

A lot of budgeting apps are designed to work best on mobile, and may not even have a desktop interface. If you're someone who prefers to work on a desktop you should look for apps that are designed to support that.

For instance, Mint has an excellent desktop interface, while Truebill is barely functional on a desktop.

Related: Real Estate Investing Apps

Advantage Of Using A Free App Over A Paid App

There are a lot of budgeting apps out there to choose from, so why should you stick to one of the free apps?

The truth is that a lot of paid apps end up costing as much as they save you. That's because of a combination of apps that don't provide the services their users need, to users that don't take full advantage of the app, or costs that add up over time.

Free apps don't have the same risks. Instead, since you aren't paying for a membership or the features of the app, any benefit you get is all profit.

Unfortunately, the free version of paid apps often aren't as effective as budgeting apps that were designed to be free. A free budgeting app is designed to make money other ways, so they don't need to get fees or subscription payments from users.

While some people succeed with paid apps, using a free budgeting app is usually better to start and may be all most users need to start saving.

Related: How to Live Below Your Means

Final Thoughts on Truebill vs Mint

One of the best signs that you've chosen the right budgeting app is that budgeting gets a lot easier and more doable.

Whether you end up using Truebill, Mint, or something else, your budgeting should be simple and the app should make it less stressful.

Meeting your financial goals doesn't have to be hard. All you need to do is find the tools that help.

Don't worry – we hate spam too. Unsubscribe at any time.