If you have some extra cash, why not use it to make more money?

Making more money is easier than you think, and there are a number of ways to do it. By growing your money you can pay down debts, save for the future, or simply have more spending money.

But you'll need to be careful. By making the wrong investments you could lose money and be in a worse position than before.

In this post, I'll explore how to turn money into more money, some tips to help you build wealth and grow your net worth, and much more. Let's get started!

Best Ways to Turn Money into More Money

Below are some of the best methods to turn money into more money. Whether you have $10, or $10,000 – give these ideas a try to watch your wealth grow.

Invest in Index Funds

Index funds are a great stock market investment to turn money into more money without doing any work.

With this investment, you simply put your money into a fund that tracks a certain market index, like the S&P 500. This gives you exposure to a broad range of stocks, and as the market goes up, your investment will too.

Index funds typically yield around 7% to 10% depending on the year making them a great appreciating asset to build wealth and make money.

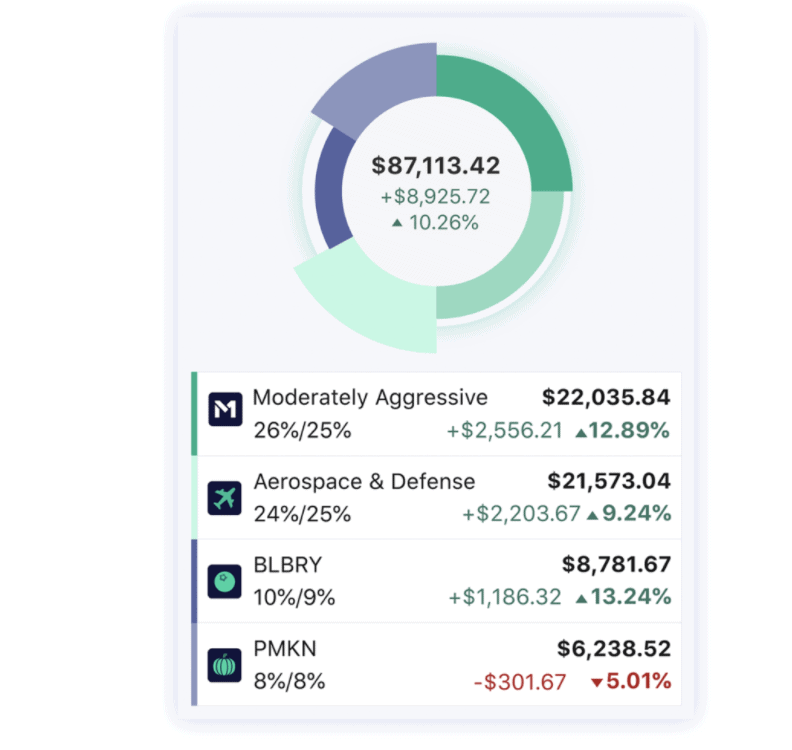

To purchase index funds, I recommend using an investing app like Acorns or M1 Finance. With Acorns, you can invest in a variety of stock market assets to grow your money and earn passive income. As a bonus, you'll get $10 completely free to start investing when you create an account with the link below!

Invest in Crowdfunded Real Estate

Making money with real estate is a great option for both new and experienced investors looking to turn their money into more money.

By using a platform like Fundrise you can easily start investing in real estate without having to deal with tenants, property management, or repairs.

The returns for Fundrise range from 8% to 12%, which is similar to some stock market investments but this will help you achieve a diversified portfolio. The platform focuses on long term investments like apartment buildings to build value.

You don't need a significant amount of money to invest money with Fundrise, either. You can start with just $10 and you'll also get a free $10 when you create an account with the link below!

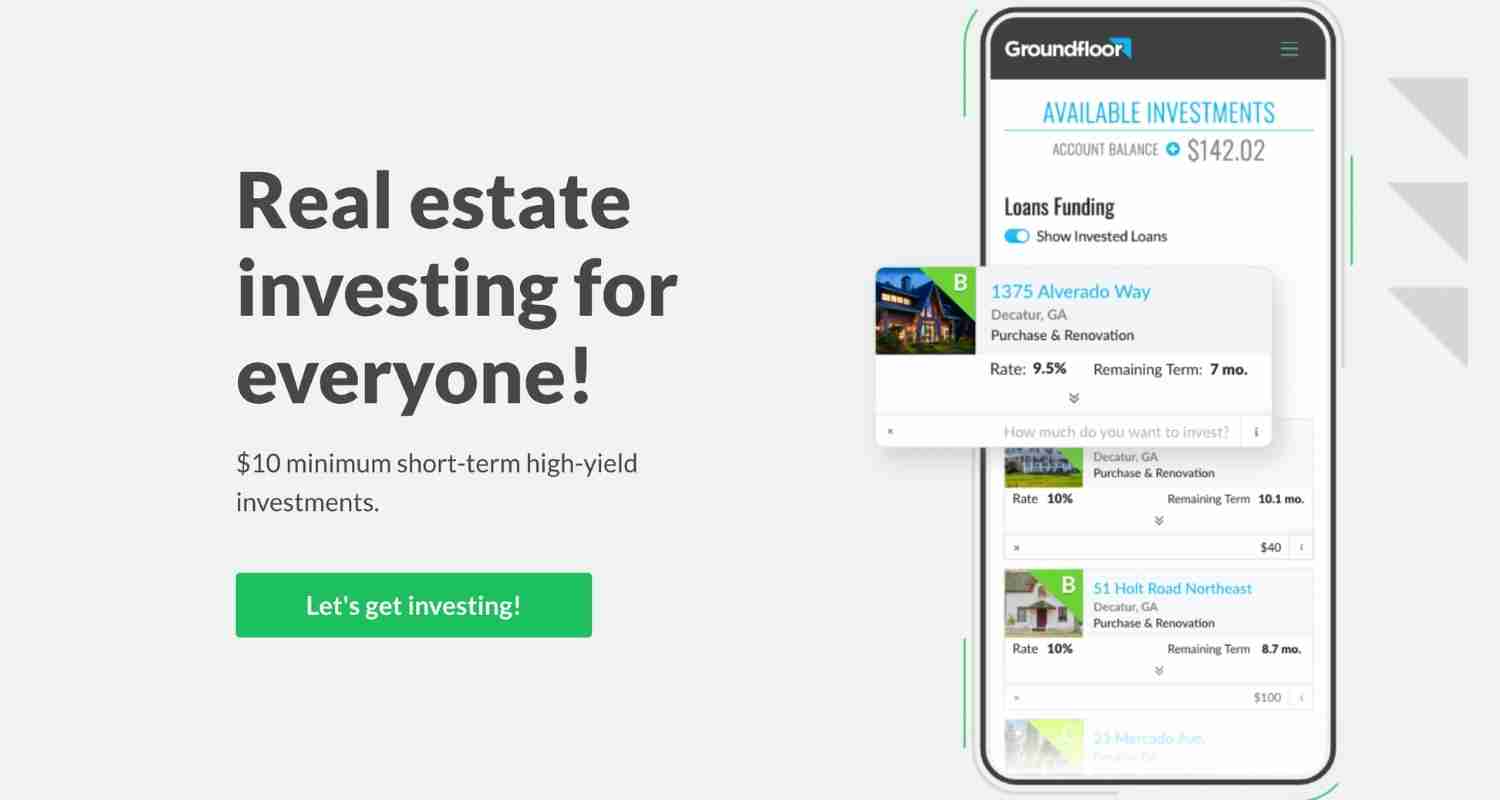

If you're looking for short term investments, a platform like Groundfloor could be a better option.

Groundfloor allows you to start investing with just $10. Instead of buying into large assets, you're be investing in debts that real estate developers need to complete their investments.

For example, many home flippers might use Groundfloor to find money to complete their next flip. These short term investments pay interest rates of around 10%, so you can see how they could turn money into more money.

Create your Groundfloor account below to get started!

Invest in Commercial Real Estate

If you have more money to invest, using a platform like EquityMultiple to build wealth with commercial real estate is a great choice.

EquityMultiple has had historic returns averaging 17.4%, which is might higher than other investments making it a great way to make compound interest.

Commercial real estate also offers lower risk than other investments because it tends to be more stable.

Create your account below to get started!

Invest in ETFs

ETFs, or exchange traded funds, are some of the best stock market investments outside of an index fund.

You can think of an ETF as a group of stocks and other securities packaged in one investment. This makes it easy for you to invest in a number of different assets at once to keep your portfolio diversified.

ETFs tend to have lower fees than mutual funds, and you can buy them through most any investment app like Acorns or M1 Finance.

Grow Your Money Investing in Small Businesses

Small businesses can be extremely profitable but not everyone wants to spend the time and money to start them/

That's where an online platform like Mainvest comes into play. Mainvest allows you to easily invest in small businesses across the country with as little as $100.

With target returns of 10% to 25%, this can be an excellent way to turn money into more money. Create your account below to get started!

Build Wealth with Peer to Peer Lending

Peer to peer lending is another popular way for investors to turn money into more money by lending money to people who need it.

Peer to peer lending involves loaning people money in exchange for interest payments.

The amount of money you can make will depend on the interest rate of the loan – but it's possible to earn over 15% in some cases.

The amount of money you can make will depend on the credit rating of the borrower.

For example, a borrower with a low credit rating might offer a higher interest rate but it also comes with a larger amount of risk.

A borrower with a high credit score might offer a lower interest rate but also comes with less risk.

To get started, you can use platforms like Prosper, Peerform, or Upstart.

Invest in Mutual Funds

Mutual funds are another stock market investment you can use to turn money into more money.

Investing in a mutual fund is a great strategy for long term investors because it allows you to invest in a number of different assets at once.

This will help you to achieve a well-diversified portfolio that will protect you from any one asset dropping in price.

Mutual funds tend to have higher fees than other investment options, but they can also perform better than their competitors.

Mutual funds can return anywhere from 7% to over 15% depending on the fund.

If you have a low risk tolerance and want to invest in the stock market, owning a mutual fund is a great option.

You can use an investing app like M1 Finance to get started!

Invest in Dividend Stocks

If you're looking for an investment that pays monthly or semi-annually, owning dividend stocks can be an excellent choice if you complete your due diligence.

Dividend stocks are stocks that pay a dividend to their shareholders from their profits. These companies tend to be more mature and in lower growth stages of their lifecycle.

For example, companies like Coca-Cola and PepsiCo are excellent dividend stocks because they have a long history of paying dividends to shareholders.

Many investment strategies will use dividend stocks to create a passive income stream for their portfolio.

Earn Passive Income with a High Yield Savings Account

If you want to make compound interest with little risk, using a high yield savings account can be an excellent avenue to store your capital while earning a little money at the same time.

You won't make money fast with this method, but if you have a low risk tolerance, this can be a great option.

You can find high yield savings accounts at most banks, and they generally offer an interest rate of .25% to 1% annually.

My favorite account is through CIT Bank. They offer industry leading interest rates and no fees. All it takes is $100 to open your account, so open your account below!

Invest in Rental Properties

Rental properties are a great money making machine you can take advantage of to make extra money.

Many investors have turned a few rental properties into massive empires with huge returns.

You'll need some capital in order to purchase a rental property, but it can be a great way to turn your money into more money.

To get a mortgage for your investment property you'll need to have at least 20% for a down payment and the income to support the mortgage in case your tenants do not pay.

Investment properties can make money through several ways:

- Rental income

- Appreciation

- Rental appreciation

- Mortgage pay down

The annual rate of return can be greater than 20% in many cases depending on your investment.

Turn Money into More Money with REITs

REITs, or real estate investment trusts, are another form of real estate investing that can be an excellent way for most people to grow their money.

REITs are a collection of properties that are put into a trust and then offered to investors through the stock market – making them extremely easy to invest in.

REITs offer a way for people to invest in real estate without having to actually purchase a property.

You can earn over 10% annually for some REITs and you can use an investing app to get started.

Start a Business

Starting a business is a great option if you have the motivation and hustle to start and grow your company.

While businesses can be a lot more work than other investment options, they can also be much more profitable and produce healthy returns. There are many benefits of being an entrepreneur including:

- Being your own boss

- Unlimited income potential

- Greater flexibility

Starting a business does come with risk, however. Around 20% of businesses fail within the first year of operations, making it seem like a high risk venture.

However, there are some strategies to mitigate some risk when opening a new business. For example, I recommend starting a small business with an obvious path to profitability before going all in on serial entrepreneurship.

There are many companies that have boostrapped there way to success, so don’t let the high failure rate scare you off.

There are plenty of business ideas for women and men that you can start.

Start a Blog

Blogging can be a fun and rewarding way to make money without investing a fortune.

In fact, the cost to start a blog is quite low, at just under $100 per year.

While this isn't a quick way to make money, it be be extremely effective with the right strategies.

To start a blog, you'll need to purchase a domain name and hosting. I recommend using Namecheap to secure your domain and SiteGround for hosting. These platforms are industry leaders and extremely affordable.

Next, you'll want to install a CMS like WordPress. This is completely free and makes managing the content on your blog easy.

Finally, it's time to start creating content and promoting it to the world.

Unfortunately, your work as a blogger isn't over once you hit publish. You'll need to network with others to promote your post to grow your audience.

By using free traffic sources like SEO and social media networks, you can grow your audience and start making money from your blog.

There are many different ways blogs can make money but some of the most common include affiliate marketing, display advertising, and sponsored content.

The income potential from blogging is limitless. Some types of blogs are capable of earning $10k a month or more.

Try a Flipping Side Hustle

If you don't have a ton of money to get started but you have some free time, flipping can be a great side hustle to make money on the side.

With this gig, you'll buy items (usually at a discount) and then sell them for a higher price.

You can find items to flip on websites like Craigslist, eBay, or Facebook Marketplace or you can visit local thrift stores and garage sales.

The amount of money you can make will depend on the number of items you can flip and your average profit margin on each item.

Some flippers are capable of making over 6-figures from their efforts making it a worthwhile venture.

Invest in Yourself

Investing in yourself is one of the best investments you can make and your future self will certainly thank you for doing it.

There are plenty of ways to invest in yourself including:

- Furthering your education

- Prioritizing mental and physical health

- Building relationships

For example, learning a new skill can help to boost your pay at your current employer or help you start your own business.

Similarly, improving your health can lead to a longer and more productive life. And, investing in strong relationships can lead to more opportunities and support down the line.

While you might not see the monetary benefit immediately from investing in yourself, over time it can be extremely valuable.

Utilize Retirement Accounts

Retirement accounts like a Roth IRA or 401k can be great tools to pad your retirement savings and save money on your taxes.

While these accounts aren't a specific investment, they can be used to invest in a number of different assets.

Related: What to Do with 50k?

Final Thoughts on How to Turn Money into More Money

Turning money into more money is simpler than you might think.

By investing in the stock market, using real estate investing platforms like Fundrise, and growing your money through side hustles – you have plenty of options.

If you want to enjoy life and live with less stress, building your passive income streams is essential. So what're you waiting for? Get started now!

Don't worry – we hate spam too. Unsubscribe at any time.